Larissa has been talking with the companys directors about the future of East Coast Yachts. To this

Question:

Ragan Engines, Inc., was founded nine years ago by a brother and sister€”Carrington and Genevieve Ragan€”and has remained a privately owned company. The company manufactures marine engines for a variety of applications. Ragan has experienced rapid growth because of a proprietary technology that increases the fuel efficiency of its engines with very little sacrifice in performance. The company is equally owned by Carrington and Genevieve. The original agreement between the siblings gave each 150,000 shares of stock.

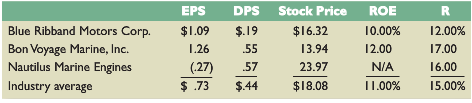

Larissa has asked Dan to determine a value per share of Ragan stock. To accomplish this, Dan has gathered the following information about some of Ragan€™s competitors that are publicly traded:

Nautilus Marine Engines€™s negative earnings per share (EPS) were the result of an accounting write-off last year. Without the write-off, EPS for the company would have been $2.07. Last year, Ragan had an EPS of $5.35 and paid a dividend to Carrington and Genevieve of $320,000 each. The company also had a return on equity of 21 percent.

Larissa tells Dan that a required return for Ragan of 18 percent is appropriate.

1. Assuming the company continues its current growth rate, what is the value per share of the company€™s stock?

2. Dan has examined the company€™s financial statements, as well as examining those of its competitors. Although Ragan currently has a technological advantage, Dan€™s research indicates that Ragan€™s competitors are investigating other methods to improve efficiency. Given this, Dan believes that Ragan€™s technological advantage will last only for the next five years. After that period, the company€™s growth will likely slow to the industry average. Additionally, Dan believes that the required return the company uses is too high. He believes the industry average required return is more appropriate. Under Dan€™s assumptions, what is the estimated stock price?

3. What is the industry average price€“earnings ratio? What is Ragan€™s price€“earnings ratio? Comment on any differences and explain why they may exist.

4. Assume the company€™s growth rate declines to the industry average after five years. What percentage of the stock€™s value is attributable to growth opportunities?

5. Assume the company€™s growth rate slows to the industry average in five years. What future return on equity does this imply?

6. Carrington and Genevieve are not sure if they should sell the company. If they do not sell the company outright to East Coast Yachts, they would like to try and increase the value of the company€™s stock. In this case, they want to retain control of the company and do not want to sell stock to outside investors. They also feel that the company€™s debt is at a manageable level and do not want to borrow more money. What steps can they take to try and increase the price of the stock? Are there any conditions under which this strategy would not increase the stock price?

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Corporate Finance

ISBN: 978-0077861759

10th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe