Lewis Real Estate purchased a new photocopy machine on January 1, 2011, for $120,000. The company's bookkeeper

Question:

Lewis Real Estate purchased a new photocopy machine on January 1, 2011, for $120,000. The company's bookkeeper made the following entry to record the acquisition:

Depreciation Expense (E, ???RE)....120,000

Cash(A).................120,000

The photocopy machine has an estimated useful life of four years and an estimated salvage value of $20,000. Lewis Real Estate did not make any adjusting entry on December 31, 2011, or in any subsequent year associated with the photocopy machine. Furthermore, the company never discovered the error.

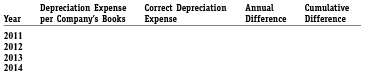

a. Assume that Lewis Real Estate uses the straight-line method to depreciate its fixed assets. Compute the values for the following chart:

b. In what direction and by how much will the accumulated depreciation account be misstated as of December 31, 2013?c. In what direction and by how much will the retained earnings account be misstated prior to closing entries on December 31, 2013?d. In what direction and by how much will the retained earnings account be misstated after closing entries on December 31,2013?

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer: