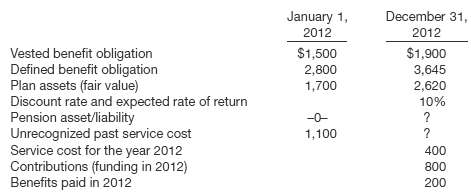

Linda Berstler Company sponsors a defined benefit pension plan. The corporation's actuary provides the following information about

Question:

Linda Berstler Company sponsors a defined benefit pension plan. The corporation's actuary provides the following information about the plan.

The average remaining service life per employee is 20 years. The average time to vesting past service costs is 10 years.

Instructions

(a) Compute the actual return on the plan assets in 2012.

(b) Compute the amount of the unrecognized net gain or loss as of December 31, 2012. (Assume the January 1, 2012, balance was zero.)

Transcribed Image Text:

January 1, 2012 December 31, 2012 Vested benefit obligation Defined benefit obligation Plan assets (fair value) Discount rate and expected rate of return Pension asset/liability Unrecognized past service cost Service cost for the year 2012 Contributions (funding in 2012) Benefits paid in 2012 $1,900 $1,500 2,800 1,700 3,645 2,620 10% -0- 1,100 400 800 200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 76% (17 reviews)

a Actual Return Ending Beginning Contributions Benefits Fair value of plan assets December 31 2012 2...View the full answer

Answered By

MICHAEL KICHE

I was employed studypool for the first time in tutoring. I did well since most of my students and clients got the necessary information and knowledge requested for. I always submitted the answers in time and followed the correct formatting in answering eg MLA or APA format,

Again I worked with the writers bay where I did writing and got many clients whom we worked with so closely. They enjoyed every single service I delivered to them. My answers are always correct.

4.70+

13+ Reviews

54+ Question Solved

Related Book For

Question Posted:

Students also viewed these Accounting questions

-

Erickson Company sponsors a defined benefit pension plan. The corporations actuary provides the following information about the plan. January 1, 2014 December 31, 2014 Vested benefit obligation...

-

Berstler Limited sponsors a defined benefit pension plan, which it accounts for using the deferral and amortization approach under PE GAAP. The corporations actuary provides the following information...

-

Berstler Limited sponsors a defined benefit pension plan, and follows ASPE. The corporation's actuary provides the following information about the plan (in thousands of dollars): Instructions (a)...

-

A vessel is in the form of an inverted cone. Its height is 8 cm and the radius of its top, which is open, is 5 cm. It is filled with water up to the brim. When lead shots, each of which is a sphere...

-

1. Often investors indicate that diversification and professional management are the two main reasons they choose mutual fund investments. How important do you consider these two factors? Why? 2....

-

Prove the following relations: EF E E F.

-

Differentiate an individual companys input market from its output market. Why are these two markets relevant to financial accounting measurements? Describe each of the four val uation bases in terms...

-

On January 1, 2018, Tennessee Harvester Corporation issued debenture bonds that pay interest semiannually on June 30 and December 31. Portions of the bond amortization schedule appear below:...

-

On January 1, Easton Company had cash on hand of $90,000. All of January's $236,000 sales were on account. December sales of $238,000 were also all on account. Experience has shown that Easton...

-

1. For laminar flow in a round pipe of diameter D, at what distance from the centerline is the actual velocity equal to the average velocity? 2. Water at 20 degrees C flows through a horizontal...

-

Buhl Corp. sponsors a defined benefit pension plan for its employees. On January 1, 2012, the following balances relate to this plan. Plan assets ........... $480,000 Defined benefit obligation ........

-

Jack Kelly Company has grown rapidly since its founding in 2002. To instill loyalty in its employees, Kelly is contemplating establishment of a defined benefit plan. Kelly knows that lenders and...

-

Lion Raisins, Inc., is a family-owned, family-operated business that grows raisins and markets them to private enterprises. In the 1990s, Lion also successfully bid on more than fifteen contracts...

-

The relationship between income and savings, let's look back to the recent credit crisis that sent our economy into the greatest financial crisis since the Great Depression. Watch this short video...

-

Jos Lpez has $15,000 in a 6-year certificate of deposit (CD) that pays a guaranteed annual rate of 4%. Create a timeline showing when the cash flows will occur. (6 points) 2. Oliver Lpez deposits...

-

PROBLEM SET #2 At a large urban college, about half of the students live off campus in various arrangements, and the other half live on campus. Is academic performance dependent on living...

-

Post a compelling argument stating whether leaders are born, made, or a combination of both. Drawing from the discussion of the two current peer-reviewed articles you identified, support your...

-

Unicorn Inc. builds commercial jets and calculate the cost for each jet. For each item below, indicate whether it would be most likely classified as direct labor (DL); direct materials (DM);...

-

Which strategy for motivating organization members presented in the chapter would you find easiest to implement? Why? Which would you find most difficult to use? Why? LO3

-

A supermarket chain is interested in exploring the relationship between the sales of its store-brand canned vegetables (y), the amount spent on promotion of the vegetables in local newspapers (x1)...

-

The penalty method is characterized by the replacement of the linear complementarity formulation of the American option model by appending a nonlinear penalty term in the BlackScholes equation. Let...

-

The company reported the following information with respect to its statement of cash flows: Cash from issuance of additional shares of stock . . . . . . . . . . . . . . . . . . . . . . . . . . . . ....

-

Earnings per Share and Dividend Payout Ratio Compute (1) Earnings per share and (2) Dividend payout ratio for Companies S and T. Indicate which of the two companies is more likely to be an older...

-

Price-Earnings Ratio and Book-to-Market Ratio Compute (1) The price-earnings ratio and (2) The book-to-market ratio for Companies M and N. Indicate which of the two companies is more likely to be in...

-

Use the following information: \ table [ [ Country , \ table [ [ Consumer Prices ] ] , Interest Rates,Current Units ( per US$ ) ] , [ Forecast , 3 - month, 1 - yx Covt Bond,, ] , [ 2 0 2 4 e ,...

-

Year-to-date, Yum Brands had earned a 3.70 percent return. During the same time period, Raytheon earned 4.58 percent and Coca-Cola earned 0.53 percent. If you have a portfolio made up of 40 percent...

-

Rate of Return If State Occurs State of Probability of Economy State of Economy Stock A Stock B Stock C Boom .15 .31 .41 .21 Good .60 .16 .12 .10 Poor .20 .03 .06 .04 Bust .05 .11 .16 .08 a. Your...

Study smarter with the SolutionInn App