Lipscomb Inc. purchased a portfolio of available-for-sale securities in 2009, its first year of operations. The cost

Question:

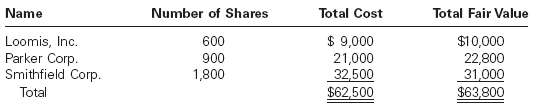

Lipscomb Inc. purchased a portfolio of available-for-sale securities in 2009, its first year of operations. The cost and fair value of this portfolio on December 31, 2009, was as follows:

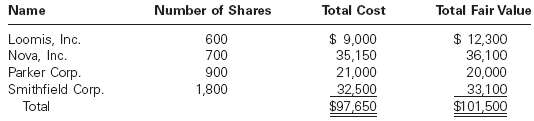

On May 10, 2010, Lipscomb purchased 700 shares of Nova Inc. at $50 per share plus a $150 brokerage fee. On December 31, 2010, the available-for-sale security portfolio had the following cost and fair value:

Provide the journal entries to record the following:(a) The adjustment of the available-for-sale security portfolio to fair value on December 31, 2009.(b) The May 10, 2010, purchase of Nova Inc. stock.(c) The adjustment of the available-for-sale security portfolio to fair value on December 31,2010.

PortfolioA portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Accounting

ISBN: 978-0324662962

23rd Edition

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren