Look again at Table 22.2. How does the value in 1982 of the option to invest in

Question:

Look again at Table 22.2. How does the value in 1982 of the option to invest in the Mark II change if:

(a)?The investment required for the Mark II is $800 million (vs. $900 million)?

(b)?The present value of the Mark II in 1982 is $500 million (vs. $467 million)?

(c) The standard deviation of the Mark II?s present value is only 20 percent (vs. 35 percent)?

Transcribed Image Text:

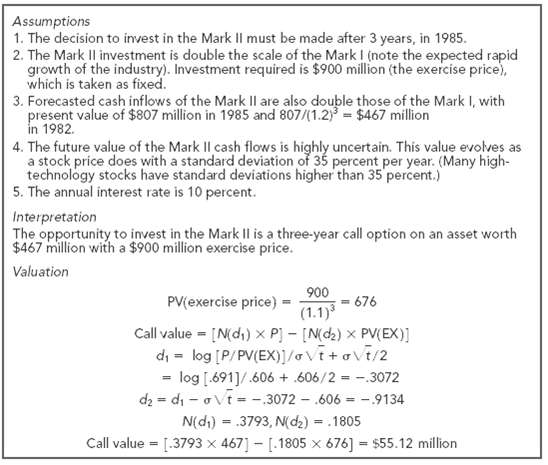

Assumptions 1. The decision to invest in the Mark Il must be made after 3 years, in 1985. 2. The Mark Il investment is double the scale of the Mark I (note the expected rapid growth of the industry). Investment required is $900 million (the exercise price), which is taken as fixed. 3. Forecasted cash inflows of the Mark Il are also double those of the Mark I, with present value of $807 million in 1985 and 807/(1.2) = $467 million in 1982. 4. The future value of the Mark II cash flows is highly uncertain. This value evolves as a stock price does with a standard deviation of 35 percent per year. (Many high- technology stocks have standard deviations higher than 35 percent.) 5. The annual interest rate is 10 percent. Interpretation The opportunity to invest in the Mark Il is a three-year call option on an asset worth $467 million with a $900 million exercise price. Valuation 900 PV(exercise price) = (1.1)3 Call value = [N(di) x P] - [Nd2) x PV(EX)] di - log [P/PV(EX)]/Vt+aVt/2 = log [.691]/.606 + .606/2 = -.3072 dz = di - o Vt = -3072 - .606 = - 9134 N(di) = .3793, N(d2) .1805 676 I3! Call value = [.3793 x 467] - [.1805 x 676] = $55.12 million

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 54% (11 reviews)

a b c P 467 EX 800 035 d logPPVEXo t0t2 l...View the full answer

Answered By

Palash Ghorai

Not much experience but try to solve every problem.Try my best

0.00

0 Reviews

10+ Question Solved

Related Book For

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers

Question Posted:

Students also viewed these Corporate Finance questions

-

The only capital investment required for a small project is investment in inventory. Profits this year were $10,000, and inventory increased from $4,000 to $5,000. What was the cash flow from the...

-

Look again at Table 9.1. This time we will concentrate on Burlington Northern. a. Calculate Burlingtons cost of equity from the CAPM using its own beta estimate and the industry beta estimate. How...

-

Look again at Table 9.1. This time we will concentrate on Norfolk Southern. TABLE 9.1 a. Calculate Norfolk Southern's cost of equity from the CAPM using its own beta estimate and the industry beta...

-

Given the sprinkler system layout in Figure A, calculate the flow and pressure required at point RN#1 (point B in Figure B) without considering the impact of velocity pressures. Note that RN#1 (point...

-

State Faraday's law.

-

Use the Standard Normal Table or technology to find the z-score that corresponds to the cumulative area or percentile. P 15

-

1. How does training create customer loyalty?

-

Consider the composite solid shown. Solid A is a thermally conductive material that is 0.5-cm thick and has a thermal conductivity, k A = 50 W/m K. The back side of solid A (x = 0) is thermally...

-

Case 21-6 Accounting for a Business Combination Achieved in Stages Company S ("S"), an SEC registrant, is an energy services holding company with utility and nonutility operations. S holds a 50...

-

Northern Tractor is a manufacturer of commercial and consumer garden tractors. In their 30 years of operation Northern has followed a traditional manufacturing process that included maintaining a...

-

After a good nights sleep, your boss, the CFO in Section 22.1, still doesnt understand. Try again. Explain why the Mark I microcomputer has a positive NPV even though DCF analyses of both the Mark I...

-

You own a one-year call option on 1 acre of Los Angeles real estate. The exercise price is $2 million, and the current, appraised market value of the land is $1.7 million. The land is currently used...

-

Refer to question 41 to find the power of a 10 % level test when the true population mean mileage is 36 miles per gallon. Question 41 An automobile manufacturer claims that a new car gets an average...

-

In the circuit of Fig. 4-51 write two loop equations using I 1 and I 2 . Then find the currents and node voltages. A 3A ( 4 3 V 792 B +1 D w 392 12 C

-

The capacitor in the circuit shown in Fig. 7-37 has initial charge Q 0 = 800 C, with polarity as indicated. If the switch is closed at t = 0, obtain the current and charge, for t > 0. 100 V (+ 10 4 F

-

A gift shop sells 400 boxes of scented candles a year. The ordering cost is \($60\) for scented candles, and holding cost is \($24\) per box per year. What is the economic order size for scented...

-

Kay Vickery is angry with Gene Libby. He is behind schedule developing supporting material for tomorrows capital budget committee meeting. When she approached him about his apparent lackadaisical...

-

Tharpe Painting Company is considering whether to purchase a new spray paint machine that costs \($3,000\) . The machine is expected to save labor, increasing net income by \($450\) per year. The...

-

Consider the example of the railway company given earlier in this chapter and now suppose that on a different route, demand follows a continuous uniform distribution with minimum demand equal to 140...

-

Suppose a population of bacteria doubles every hour, but that 1.0 x 106 individuals are removed before reproduction to be converted into valuable biological by-products. Suppose the population begins...

-

The values of G f for the hydrogen halides become less negative with increasing atomic number. The G f of HI is slightly positive. However, the trend in S f is to become more positive with increasing...

-

Suppose you want to hedge a $500 million bond portfolio with a duration of 11.6 years using 10-year Treasury note futures with a duration of 6.2 years, a futures price of 102, and 94 days to...

-

A non-dividend-paying stock is currently priced at $78.15 per share. A futures contract maturing in five months has a price of $79.25 and the risk-free rate is 4 percent. Describe how you could make...

-

A stock is currently priced at $53.87 and the futures on the stock that expire in six months have a price of $55.94. The risk-free rate is 7 percent, and the stock is not expected to pay a dividend....

-

Accounting changes fall into one of three categories. Identify and explain these categories and give an example of each one.

-

Machinery is purchased on May 15, 2015 for $120,000 with a $10,000 salvage value and a five year life. The half year convention is followed. What method of depreciation will give the highest amount...

-

Flint Corporation was organized on January 1, 2020. It is authorized to issue 14,000 shares of 8%, $100 par value preferred stock, and 514,000 shares of no-par common stock with a stated value of $2...

Study smarter with the SolutionInn App