Look back at question 11. Suppose now that Archimedes repurchases debt and issues equity so that D/V

Question:

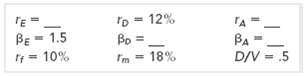

Look back at question 11. Suppose now that Archimedes repurchases debt and issues equity so that D/V = 3. The reduced borrowing causes rD to fall to 11 percent. How do the other variables change?

Transcribed Image Text:

12% 'D = 12% TE = BE = 1.5 10% BA D/V = .5 Bo = 18% I'm Im =

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (17 reviews)

We know from Proposition I that the value of the firm wi...View the full answer

Answered By

Mary Boke

As an online tutor with over seven years of experience and a PhD in Education, I have had the opportunity to work with a wide range of students from diverse backgrounds. My experience in education has allowed me to develop a deep understanding of how students learn and the various approaches that can be used to facilitate their learning. I believe in creating a positive and inclusive learning environment that encourages students to ask questions and engage with the material. I work closely with my students to understand their individual learning styles, strengths, and challenges to tailor my approach accordingly. I also place a strong emphasis on building strong relationships with my students, which fosters trust and creates a supportive learning environment. Overall, my goal as an online tutor is to help students achieve their academic goals and develop a lifelong love of learning. I believe that education is a transformative experience that has the power to change lives, and I am committed to helping my students realize their full potential.

5.00+

4+ Reviews

21+ Question Solved

Related Book For

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers

Question Posted:

Students also viewed these Corporate Finance questions

-

Look back to Problem 19. Suppose now that Archimedes repurchases debt and issues equity so that D/V = .3. The reduced borrowing causes rD to fall to 11%. How do the other variables change?

-

Look back at question 7. Assume that the change in credit terms results in a 2 percent increase in sales. Recalculate the effect of the changed credit terms.

-

Look back at Table 14.2. a. Suppose that George Weston issues 10 million shares at $55 a share. Rework the table to show the company's equity after the issue. b. Suppose that George Weston...

-

1. Identify the function of the underlined noun/s in each item. 1. On rainy mornings, is your bus usually late? 2. On the desk were the red pencils. 3. Volcanoes and earthquakes are destructive...

-

What color results when red is subtracted from white light?

-

Convert the given numeral to a numeral in base 10. 573 16

-

What are the features of a guest account?

-

On January 1, 2020, Innovus, Inc., acquired 100 percent of the common stock of ChipTech Company for $670,000 in cash and other fair-value consideration. ChipTechs fair value was allocated among its...

-

Adjustment for accrued expense City Realty pays weekly salaries of $10,875 on Monday for a six-day workweek ending the preceding Saturday. Journalize the necessary adjusting entry at the end of the...

-

Review the problem in the Work It Out titled "Interpreting the AD/AS Model." Like the information provided in that feature, Table 24.2 shows information on aggregate supply, aggregate demand, and the...

-

Archimedes Levers is financed by a mixture of debt and equity. You have the following information about its cost of capital: Can you fill in the blanks? 12% 'D = 12% TE = BE = 1.5 10% BA D/V = .5 Bo...

-

Schuldenfrei a.g. pays no taxes and is financed entirely by common stock . The stock has a beta of .8, a priceearnings ratio of 12.5, and is priced to offer an 8 percent expected return. Schuldenfrei...

-

How can template-based HTML help to make a large electronic commerce site more maintainable?

-

List the model assumptions for one-way ANOVA and briefly explain how to assess them.

-

Remember that a correctly labeled graph requires that you label all axes, curves, and equilibrium point values. The word "calculate" means you must show your work. Assume the market for Good Z is in...

-

Answer the following questions by writing a paragraph or two in English. (a) [easy] Previously we defined probability as P(A) = Describe a situtation where this fails to produce the correct...

-

Find f''(x). f(x)=5x-14x- 612x f'(x)=

-

Simplify. 32-6 3-6

-

Jay Furniture Co. uses a predetermined cost-driver rate based on direct-labor hours. For October, its budgeted overhead was $900,000 based on budgeted activity of 100,000 direct-labor hours. Actual...

-

The Ranch 888 Noodle Company sells two types of dried noodles:ramen, at $6.50 per box, and chow fun, at $7.70 per box. So farthis year, the company has sold a total of 110,096 boxes ofnoodles,...

-

If an electrolytic cell contains a mixture of species that can be oxidized, how do you determine which species will actually be oxidized? If it contains a mixture of species that can be reduced, how...

-

Suppose that the Treasury bill rate is 6% rather than 2%. Assume that the expected return on the market stays at 10%. Use the betas in Table 8.2. a. Calculate the expected return from Pfizer. b. Find...

-

An oil company is drilling a series of new wells on the perimeter of a producing oil field. About 20% of the new wells will be dry holes. Even if a new well strikes oil, there is still uncertainty...

-

The Cambridge Opera Association has come up with a unique door prize for its December 2016 fund-raising ball: Twenty door prizes will be distributed, each one a ticket entitling the bearer to receive...

-

(15 points) Stressed $2.500,000 of S% 20 year bands. These bonds were issued Jary 1, 2017 and pay interest annually on each January 1. The bonds yield 3% and was issued at $325 8S! Required (2)...

-

Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for...

-

1. A company issued 10%, 10-year bonds with a par value of $1,000,000 on January 1, at a selling price of $885,295 when the annual market interest rate was 12%. The company uses the effective...

Study smarter with the SolutionInn App