Mammoth Enterprises purchased 50 percent of the outstanding stock of Atom, Inc. on December 31 for $60,000

Question:

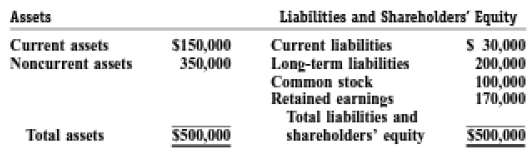

Mammoth Enterprises purchased 50 percent of the outstanding stock of Atom, Inc. on December 31 for $60,000 cash. On that date, the book value of Atom's net assets was $70,000. The market value of Atom's assets was $180,000, $20,000 above book value. Mammoth's condensed balance sheet, immediately before the acquisition, follows:

Mammoth entered into a debt covenant earlier in the year that requires the company to maintain a debt/equity ratio of less than 1: 1.REQUIRED:a. Compute Mammoth's debt/equity ratio both before and after the acquisition. Consider minority interest a liability.b. Explain why in this situation Mammoth would probably prefer the equity method instead of treating this transaction as a purchase and preparing consolidated financial statements.

Step by Step Answer: