Management of Charlottesville Bank is concerned about a loss of customers at its main office downtown. One

Question:

Management of Charlottesville Bank is concerned about a loss of customers at its main office downtown. One solution that has been proposed is to add one or more drive-through teller windows to make it easier for customers in cars to obtain quick service without parking. Neha Patel, the bank president, thinks the bank should only risk the cost of installing one drive-through window. She is

Informed by her staff that the cost (amortized over a 20-year period) of building a drive-through window is $36,000 per year. It also costs $48,000 per year in wages and benefits to staff each new drive-through window.

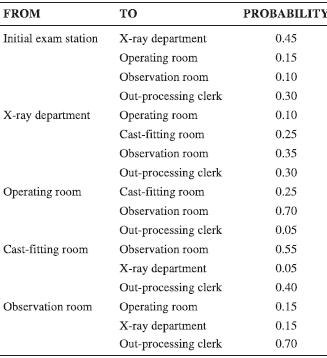

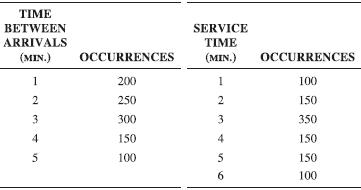

The director of management analysis, Robyn Lyon, believes that two factors encourage the immediate construction of two drive-through windows, however. According to a recent article in Banking Research magazine, customers who wait in long lines for drive-through service will cost banks an average of $3 per minute in loss of goodwill. Also, adding a second drive-through window will cost an additional $48,000 in staffing, but amortized construction costs can be cut to a total of $60,000 per year if the two drive-through windows are installed together instead of one at a time. To complete her analysis, Lyon collected arrival and service rates at a competing downtown bank’s drive-through windows for one month. These data are shown in the following table:

(a) Simulate a 1-hour time period for a system with one drive-through window. Replicate the model N times.

(b) Simulate a 1-hour time period for a system with two drive-through windows. Replicate the model N times.

(c) Conduct a cost analysis of the two options. Assume that the bank is open 7 hours per day and 200 days per year.

Step by Step Answer:

Managerial Decision Modeling With Spreadsheets

ISBN: 718

3rd Edition

Authors: Nagraj Balakrishnan, Barry Render, Jr. Ralph M. Stair