MGS Rentals, Inc.s unadjusted and adjusted trial balances at June 30, 2014, follow. Requirements 1. Make the

Question:

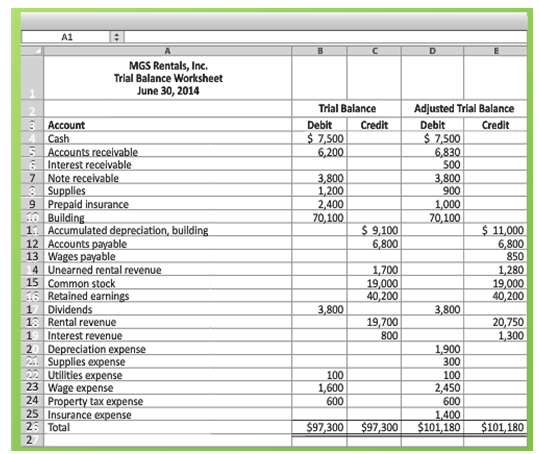

MGS Rentals, Inc.’s unadjusted and adjusted trial balances at June 30, 2014, follow.

Requirements

1. Make the adjusting entries that account for the differences between the two trial balances.

2. Compute MGS Rental’s total assets, total liabilities, net income, and totalequity.

A1 MGS Rentals, Inc. Trlal Balance Worksheet June 30, 2014 Trial Balance Adjusted Trial Balance Account Debit CreditDebit Credit S00 6,200 7,500 6,830 S00 3,800 900 1,000 70,100 Cash counts receivable Interest receivable Note receivable 3,800 Supplies 9 Prepaid insurance 1,200 2,400 70,100 Building 11 Accumulated depreciation, building 12 Accounts payable 13 Wages payable $ 9,100 6,800 1,700 19,000 $11,000 6,800 850 1,280 19,000 40,200 4 Unearned rental revenue 15 Common stock Retained earnings 40,200 1 Dividends 3,800 3800 18 Rental revenue 19 Interest revenue 2 Depreclation expense 19,700 800 20,750 1,300 1900 300 100 2,450 500 Supplies expense Utilities expense 23 Wage expense 24 Property tax expense 25 Insurance expense 2: Total 100 1,600 600

Step by Step Answer:

Req 1 Journal DATE ACCOUNT TITLES AND EXPLANATION DEBIT CREDIT June 30 Accounts Receivable 6830 6200 ...View the full answer

Financial Accounting

ISBN: 978-0133427530

10th edition

Authors: Walter Harrison, Charles Horngren, William Thomas

Related Video

A trial balance is a list of all the general ledger accounts contained in the ledger of a business. This list will contain the name of each nominal ledger account and the value of that nominal ledger balance. Each nominal ledger account will hold either a debit balance or a credit balance

Students also viewed these Accounting questions

-

Peppertree Rentals, Inc.'s, unadjusted and adjusted trial balances at June 30, 2016, follow: Requirements 1. Make the adjusting entries that account for the differences between the two trial...

-

Appletree Rental Companys unadjusted and adjusted trial balances at June 30, 2018, follow. Requirements 1. Make the adjusting entries that account for the differences between the two trial balances....

-

Crossway Rental Companys unadjusted and adjusted trial balances at June 30, 2018, follow: Requirements 1. Make the adjusting entries that account for the differences between the two trial balances....

-

Two different compounds have the formulation CoBr(SO4) 5NH3. Compound A is dark violet, and compound B is red-violet. When compound A is treated with AgNO3 (aq), no reaction occurs, whereas compound...

-

The speed at which you can log into a website through a smart phone is an important quality characteristic of that website. In a recent test, the mean time to log into the Hertz website through a...

-

In Problem find the area bounded by the graphs of the indicated equations over the given intervals (when stated). Compute answers to three decimal places. y = x 2 - 4; y = 0; -2 x 4

-

If the actual termination of a project is a project in itself, how is it different from other projects? LO4

-

Complete the following questions using the MIP for 9-City Example.xls spreadsheet found on the book web site and reviewed previously in this chapter: a. What are the best two locations with the given...

-

On January 1, 2018, Carvel Corp. issued five-year bonds with a face value of $640,000 and a coupon interest rate of 6%, with interest payable semi-annually. Assume that the company has a December 31...

-

A national catalog and Internet retailer has three warehouses and three major distribution centers located around the country. Normally, items are shipped directly from the warehouses to the...

-

Consider the unadjusted trial balance of WOW, Inc., at July 31, 2014, and the related month-end adjustment data. Adjustment data at July 31, 2014: a. Accrued service revenue at July 31, $3,950. b....

-

The adjusted trial balance of Griffith Corporation at March 31, 2014, follows. Requirements 1. Prepare Griffith Corporations 2014 single step income statement, statement of retained earnings, and...

-

Divide into small groups, each led by a member who has worked for a sales commission. Discuss how the commission related to both equity theory and expectancy theory, and report highlights of your...

-

An epidemiologist plans to conduct a survey to estimate the percentage of women who give birth. How many women must be surveyed in order to be 90% confident that the estimated percentage is in error...

-

Palmerstown Company established a subsidiary in a foreign country on January 1, Year 1, by investing 8,000,000 pounds when the exchange rate was $1.00/pound. Palmerstown negotiated a bank loan of...

-

Question 1.Which of the following plans provide the greatest immediate tax benefit for the participating employee? (1) Roth IRA (2) deductible IRA (3) non-deductible IRA (4) 401(k) a. (1) and (3)...

-

Transcribed image text: 9:13 LTE Done 7 of 7 QUESTION WA AUDION QUESTION 23 = w the tons of a coin comes down heads, you win two dollars. If it comes down tails, you lose fifty cents. How much would...

-

TRUE or FALSE It is 2016 and the D.C. Circuit has issued its ruling in USTA v. FCC . The D.C. Circuit upheld the 2015 Open Internet Order so the FCC's net neutrality rule stands.True or...

-

Using suitable data, explain why the market price of an ordinary share is likely to fluctuate more in a highly geared than in a low-geared company. Why would you prefer to be an ordinary shareholder...

-

Consider the combustion of methanol below. If 64 grams of methanol reacts with 160 grams of oxygen, what is the CHANGE in volume at STP. 2CH3OH(g) + 3O2(g) 2CO2(g) + 4H2O(1) The volume decreases by...

-

Trudy and Yvonne have come together to run Salford Childrens Center. The center receives state and federal grants, and whatever is left over is put back into the center to improve and expand its...

-

Tucker, Inc., has the following plant asset accounts: Land, Buildings, and Equipment, with a separate accumulated depreciation account for each of these except Land. Tucker completed the following...

-

On January 2, 2016, Smythe Co. paid $255,000 for a computer system. In addition to the basic purchase price, the company paid a setup fee of $1,500, sales tax of $6,600, and $31,900 for a special...

-

Hometown Sales, Inc., sells electronics and appliances. The excerpts that follow are adapted from Hometown Sales' financial statements for 2016 and 2015: Requirements 1. How much was Hometown Sales's...

-

Minden Company introduced a new product last year for which it is trying to find an optimal selling price. Marketing studies suggest that the company can increase sales by 5,000 units for each $2...

-

Prepare the adjusting journal entries and Post the adjusting journal entries to the T-accounts and adjust the trial balance. Dresser paid the interest due on the Bonds Payable on January 1. Dresser...

-

Venneman Company produces a product that requires 7 standard pounds per unit. The standard price is $11.50 per pound. If 3,900 units required 28,400 pounds, which were purchased at $10.92 per pound,...

Study smarter with the SolutionInn App