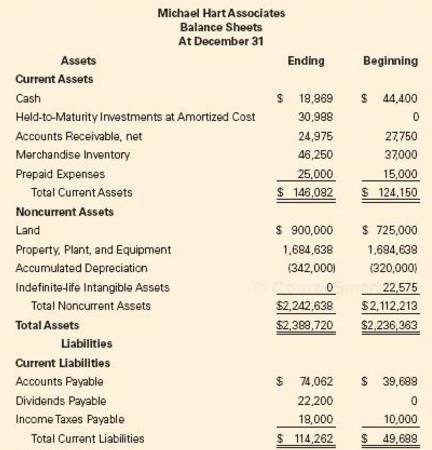

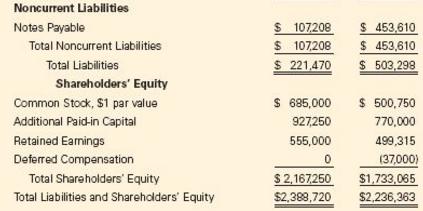

Michael Hart Associates closed its books for the current year. The firm provided the following comparative balance

Question:

Michael Hart Associates closed its books for the current year. The firm provided the following comparative balance sheets and income statement.

Michael Hart Associates

Income Statement

For the Year Ended December 31

Current Year

Sales…………………………………………… $ 795,000

Cost of Goods Sold……………………………. 477,000

Gross Profit…………………………………….. $ 318,000

Selling, General, and Administrative Expenses… $ 83,250

Bad Debt Expense………………………………. 8,000

Depreciation Expense…………………………… 22,000

Total Operating Expenses……………………….. $ 113,250

Income before Interest and Taxes……………….. $ 204,750

Interest Expense…………………………………. $ (7,369)

Dividend Income………………………………… 1,650

Income Before Tax………………………………. $ 199,031

Income Tax Expense…………………………….. (79,612)

Net Income………………………………………. $ 119,419

Additional Information:

The company sold its indefinite-life intangible assets at their carrying value. Cash was used to acquire land.

Required

Prepare the company’s cash flow statement for the current year under the indirect method. Present any required disclosures.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0132162302

1st edition

Authors: Elizabeth A. Gordon, Jana S. Raedy, Alexander J. Sannella