Most clients are referred to the company by potential employers who pay for the tests. Revenue and

Question:

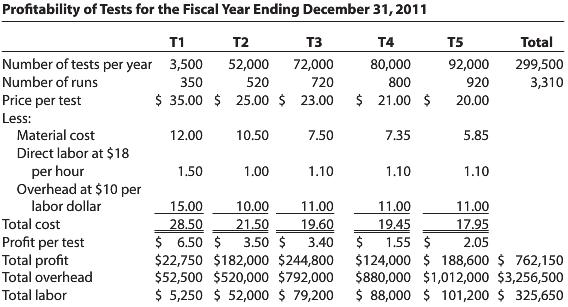

Most clients are referred to the company by potential employers who pay for the tests. Revenue and costs related to the tests, for the most recent fiscal year, are detailed in the table below.

Setting up equipment to conduct a test is the responsibility of three highly skilled technicians, one of whom is Emmet Wilson, founder and owner of the company. Tests T2 to T5 are high-volume tests that are conducted in batches of 100 tests per batch. Thus, for example, T5 is run approximately three times a day to annually process 92,000 tests in 920 batches. T1 is a test with relatively low demand. However, it is run almost every day (350 runs per year), so that results can be quickly communicated to employers. This fast turnaround represents a significant competitive advantage for the company.

ABC cost of the five tests. In the past year, overhead amounted to $3,256,500,as follows:

Overhead Costs

Setup labor …………………….. $ 875,000

Equipment ……………………. 1,400,000

Rent …………………………… 390,000

Billing ………………………… 231,500

Clerical ……………………….. 160,000

Other ………………………….. 200,000

Total …………………………… $3,256,500

Emmet’s analysis of these six overhead cost categories was as follows:

Required

a. Based on Emmet’s assumptions, calculate the ABC cost per unit and profit per unit of each test.

b. Should Emmet lower the price of the T1 test, or keep the current price and risk losing the business of Nuclear Systems?

c. Assume that Emmet, based on his ABC analysis, decides not to lower the price of the T1 test. What will be the effect on annual company profit if the company loses the business of Nuclear Systems (i.e., T1 tests decrease by 1,750)?

Step by Step Answer: