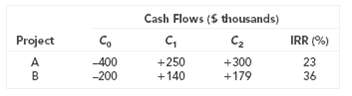

Mr. Cyrus Clops, the president of Giant Enterprises, has to make a choice between two possible investments:

Question:

Mr. Cyrus Clops, the president of Giant Enterprises, has to make a choice between two possible investments:

The opportunity cost of capital is 9 percent. Mr. Clops is tempted to take B, which has the higher IRR.

a. Explain to Mr. Clops why this is not the correct procedure.

b. Show him how to adapt the IRR rule to choose the best project.

c. Show him that this project also has the higherNPV.

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Principles of Corporate Finance

ISBN: 978-0072869460

7th edition

Authors: Richard A. Brealey, Stewart C. Myers

Question Posted: