(NOL without Valuation Account) Jennings Inc. reported the following pretax income (loss) and related tax rates during...

Question:

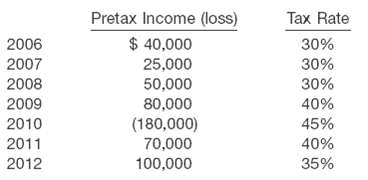

(NOL without Valuation Account) Jennings Inc. reported the following pretax income (loss) and related tax rates during the years 2006' ?2012. Pretax financial income (loss) and taxable income (loss) were the same for all years since Jennings began business. The tax rates from 2009' ?2012 were enacted in 2009.

(a) Prepare the journal entries for the years 2010' ?2012 to record income tax payable (refundable), income tax expense (benefit), and the tax effects of the loss carry back and carry forward. Assume that Jennings elects the carry back provision where possible and expects to realize the benefits of any loss carry forward in the year that immediately follows the loss year.

(b) Indicate the effect the 2010 entry(ies) has on the December 31, 2010, balance sheet.

(c) Prepare the portion of the income statement, starting with 'Operating loss before income taxes,'? for 2010.

(d) Prepare the portion of the income statement, starting with 'Income before income taxes,' for 2011.

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0470423684

13th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, And Terry D. Warfield