On January 1, 2012, Pruitt Company issued 25,500 shares of its common stock in exchange for 85%

Question:

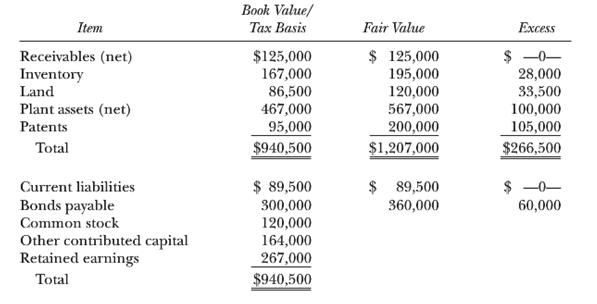

On January 1, 2012, Pruitt Company issued 25,500 shares of its common stock in exchange for 85% of the outstanding common stock of Shah Company. Pruitt’s common stock had a fair value of $28 per share at that time (par value of $2 per share). Pruitt Company uses the cost method to account for its investment in Shah Company and files a consolidated income tax return. A schedule of the Shah Company assets acquired and liabilities assumed at book values (which are equal to their tax bases) and fair values follows.

Additional Information:

1. Pruitt’s income tax rate is 35%.

2. Shah’s beginning inventory was all sold during 2012.

3. Useful lives for depreciation and amortization purposes are:

Plant assets........10 years

Patents...........8 years

Bond premium........ 10 years

4. Pruitt uses the straight-line method for all depreciation and amortization purposes.

Required:

A. Prepare the stock acquisition entry on Pruitt Company’s books.

B. Prepare the eliminating entries for a consolidated statements workpaper on January 1, 2012, immediately after acquisition.

Common stock is an equity component that represents the worth of stock owned by the shareholders of the company. The common stock represents the par value of the shares outstanding at a balance sheet date. Public companies can trade their stocks on...

Step by Step Answer: