Question: On January 2, 2011, Par Corporation issues its own $10 par common stock for all the outstanding stock of Sin Corporation in an acquisition. Sin

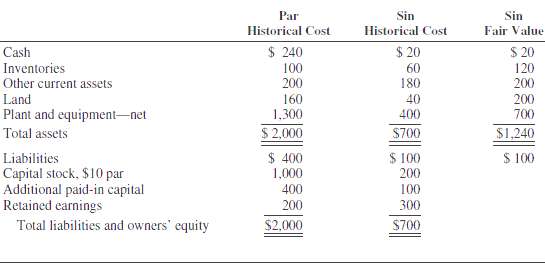

On January 2, 2011, Par Corporation issues its own $10 par common stock for all the outstanding stock of Sin Corporation in an acquisition. Sin is dissolved. In addition, Par pays $40,000 for registering and issuing securities and $60,000 for other costs of combination. The market price of Par's stock on January 2, 2011, is $60 per share. Relevant balance sheet information for Par and Sin Corporations on December 31, 2010, just before the combination, is as follows (in thousands):

1. Assume that Par issues 25,000 shares of its stock for all of Sin's outstanding shares.a. Prepare journal entries to record the acquisition of Sin.b. Prepare a balance sheet for Par Corporation immediately after the acquisition.2. Assume that Par issues 15,000 shares of its stock for all of Sin's outstanding shares.a. Prepare journal entries to record the acquisition of Sin.b. Prepare a balance sheet for Par Corporation immediately after theacquisition.

Par Sin Sin Fair Value Historical Cost Historical Cost $ 240 $ 20 $ 20 120 200 Cash Inventories Other current assets Land Plant and equipment-net 100 200 60 180 160 40 400 200 700 1,300 $2,000 S700 $ 100 Total assets $1,240 $ 400 1,000 $ 100 Liabilities Capital stock, $10 par Additional paid-in capital Retained earnings 200 400 100 200 300 Total liabilities and owners' equity $2,000 $700

Step by Step Solution

3.33 Rating (174 Votes )

There are 3 Steps involved in it

Par issues 25000 shares of stock for Sins outstanding shares 1a Investment in Sin 1500000 Capital stock 10 par 250000 Additional paidin capital 125000... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

55-B-A-B-C (13).docx

120 KBs Word File