On July 1 of this year, R. Green established the Green Rehab Clinic. The organizations account headings

Question:

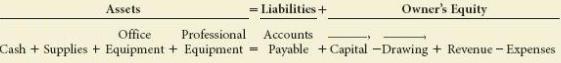

On July 1 of this year, R. Green established the Green Rehab Clinic. The organization’s account headings are presented below. Transactions completed during the month of July follow.

a. Green deposited $ 30,000 in a bank account in the name of the business.

b. Paid the office rent for the month, $ 1,800, Ck. No. 2001 (Rent Expense).

c. Bought supplies for cash, $ 362, Ck. No. 2002.

d. Bought professional equipment on account from Rehab Equipment Company, $ 18,000.

e. Bought office equipment from Hi- Tech Computers, $ 2,890, paying $ 890 in cash and placing the balance on account, Ck. No. 2003.

f. Sold professional services for cash, $ 4,600 (Professional Fees).

g. Paid on account to Rehab Equipment Company, $ 700, Ck. No. 2004.

h. Received and paid the bill for utilities, $ 367, Ck. No. 2005 (Utilities Expense).

i. Paid the salary of the assistant, $ 1,150, Ck. No. 2006 (Salary Expense).

j. Sold professional services for cash, $ 3,868 (Professional Fees).

k. Green withdrew cash for personal use, $ 1,800, Ck. No. 2007.

Required

1. In the equation, write the owner’s name above the terms Capital and Drawing.

2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses.

3. Write the account totals from the left side of the equal sign and add them. Write the account totals from the right side of the equal sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, reanalyze each transaction.

Step by Step Answer:

College Accounting

ISBN: 978-1111528126

11th edition

Authors: Tracie Nobles, Cathy Scott, Douglas McQuaig, Patricia Bille