On the basis of the following data, estimate the cost of the merchandise inventory at November 30

Question:

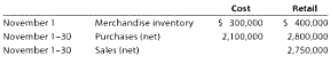

On the basis of the following data, estimate the cost of the merchandise inventory at November 30 by the retailmethod:

Transcribed Image Text:

Retail Cost November 1 November 1-30 November 1-30 Merchandise inwentory Purchases (net) Sales (net) $ 400,000 2,800.000 2,100,000 2,750.000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (8 reviews)

A B C 1 Cost Retail 2 Merchandise inventory November 1 300000 400000 3 Purchases ...View the full answer

Answered By

Joemar Canciller

I teach mathematics to students because I love to share what I have in this field.

I also want to see the students to love math and be fearless in this field.

I've been tutoring these past 2 years and I would like to continue what I've been doing.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Financial and Managerial Accounting

ISBN: 978-0538480895

11th Edition

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren

Question Posted:

Students also viewed these Managerial Accounting questions

-

On the basis of the following data for Grant Co. for 2010 and the preceding year ended December 31, 2009, prepare a statement of cash flows. Use the indirect method of reporting cash flows from...

-

On the basis of the following data for Breach Co. for the current and preceding years ended December 31. Assume that equipment costing $25,000 was purchased for cash and no long term assets were sold...

-

On the basis of the following data related to current assets for Mission Co. at December 2016, prepare a partial balance sheet in good form. Cash and cash equivalents $100,000 Notes receivable 50,000...

-

Raider Company manufactures and sells multiple products. The traditional costing system allocates overhead costs based on direct labor hours, while the company is considering transitioning to an...

-

Outline an essay using the Toulmin Method of Argumentation, with the following factors introduction, background, and support for your claim, opposing views, rebuttals, and a conclusion. Proposed a...

-

What are the four categories used in cost of quality reports? How do they differ from each other? Why do we care about separating costs into these categories?

-

Bill Beck, Bruce Beck, and Barb Beck formed the BBB Partnership by making capital contributions of $67,500, $262,500, and $420,000, respectively. They predict annual partnership net income of...

-

Susan May Bakery, Inc. reported a prior-period adjustment in 2016. An accounting error caused net income of prior years to be overstated by $4,000. Retained Earnings at December 31, 2015, as...

-

Current Attempt in Progress Crane Company manufactures one product. On December 31, 2019. Crane adopted the dollar-value LIFO inventory method. The inventory on that date using the dollar-value LIFO...

-

How does the balance in Allowance for Doubtful Accounts before adjustment affect the amount of the year-end adjustment under the percentage of sales method? Under the percentage of receivables method?

-

Kroger, Safeway Inc., and Winn-Dixie Stores Inc. are three grocery chains in the United States. Inventory management is an important aspect of the grocery retail business. Recent balance sheets for...

-

The merchandise inventory was destroyed by fire on December 13. The following data were obtained from the accounting records: a. Estimate the cost of the merchandise destroyed.b. Briefly describe the...

-

Determine whether the argument is valid or invalid. You may compare the argument to a standard form, or use a truth table. r : per

-

Global Operations Management is supported by Strategic Supply Chain Management in many ways. Elucidate the following; List and briefly define/describe the Five (5) Components of Strategic Supply...

-

The Alpine House, Inc. is a large winter sports equipment broker. Below is an income statement for the company's ski department for a recent quarter. LA CASA ALPINA, INC. Income Statement - Ski...

-

Two investment portfolios are shown. Investment Portfolio 1 Portfolio 2 ROR Savings Account $1,425 $4,500 2.80% Government Bond $1,380 $3,600 1.55% Preferred Stock $3,400 $2,150 11.70% Common Stock...

-

The following information pertains to JAE Corporation at January 1, Year 1: Common stock, $8 par, 11,000 shares authorized, 2,200 shares issued and outstanding Paid-in capital in excess of par,...

-

Group dynamics are important elements within the leading facet of the P-O-L-C framework. Discuss a time in your professional, school, or personal life when you experienced the Five Stages of Group...

-

If one is seeking to find more Type 3 (contextual evidence), what are the methods for obtaining this information?

-

Wholesalers Ltd. deals in the sale of foodstuffs to retailers. Owing to economic depression, the firm intends to relax its credit policy to boost productivity and sales. The firms current credit...

-

Discuss two examples of more complex embedded options than traditional callable, puttable, and convertible bonds.

-

Mr. Altgeldt has $5,000 to invest. He wants to know how much it will amount to if he invests it at the following rates: a. 6% per year for 21 years b. 8% per year for 33 years Required: Calculations...

-

Mme Barefield wishes to base $150,000 at the end of 8 years. How much must she invest today to accomplish this purpose if the interest rate is? a. 6% per year? b. 8% per year? Required: Calculations...

-

Mr. Case plans to set aside $4,000 each year, the unit payment to be made on January 1, 2008, and the last on January 1, 2013. How much will he have accumulated by January 1, 2010. If the interest...

-

When direct materials are issued from the storeroom, are any entries made in the subsidiary records? Question 2 options: Increase raw material item record Decrease raw material item record No entry...

-

Riverrun Co. provides medical care and insurance benefits to its retirees. In the current year, Riverrun agrees to pay $5,500 for medical insurance and contribute an additional $9,000 to a retirement...

-

DETAILS 1. [-/1 Points) SMITHNM13 11.2.025. MY NOTES Convert the credit card rate to the APR. Oregon, 2% per month % Need Help? ReadIt Watch

Study smarter with the SolutionInn App