Organic Solutions (OS), one of the nations largest plant wholesalers in the southeastern United States, was poised

Question:

Organic Solutions (OS), one of the nation’s largest plant wholesalers in the southeastern United States, was poised for expansion. Through strong profitability, a conservative dividend policy, and some recent realized gains in real estate, OS had a strong cash position and was searching for a target company to acquire. The executive members on the acquisition search committee had agreed that they preferred to find a firm in a similar line of business rather than one that would provide broad diversification. This would be their first acquisition, and they preferred to stay in a familiar line of business. Jennifer Morgan, director of marketing, had identified the targeted lines of business through exhaustive market research.

Ms. Morgan had determined that the servicing of plants in large commercial offices, hotels, zoos, and theme parks would complement the existing wholesale distribution business. Frequently, OS was requested by its large clients to bid on a service contract. However, the company was neither staffed nor equipped to enter this market. Ms. Morgan was familiar with the major plant service companies in the Southeast and had suggested Green Thumbs, Inc. (GTI), as an acquisition target because of its significant market share and excellent reputation.

GTI had successfully commercialized a market that had been dominated by small local contractors and in-house landscaping departments. Beginning with a contract from one of the largest theme parks in the United States, GTI’s growth in sales had compounded remarkably over its 8-year history. GTI had also been selected because of its large portfolio of long-term service contracts with several major Fortune 500 companies.

These contracted clients would provide a captive customer base for the wholesale distribution of OS’s plant products.

At the National Horticultural meeting in Los Angeles this past March, Ms. Morgan and OS’s chief financial officer, Jack Levine, had approached the owner of GTI (a closely held corporation) to determine whether a merger offer would be welcomed.

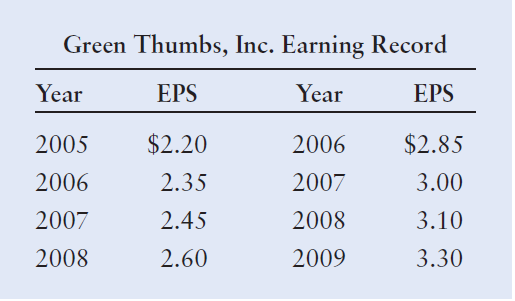

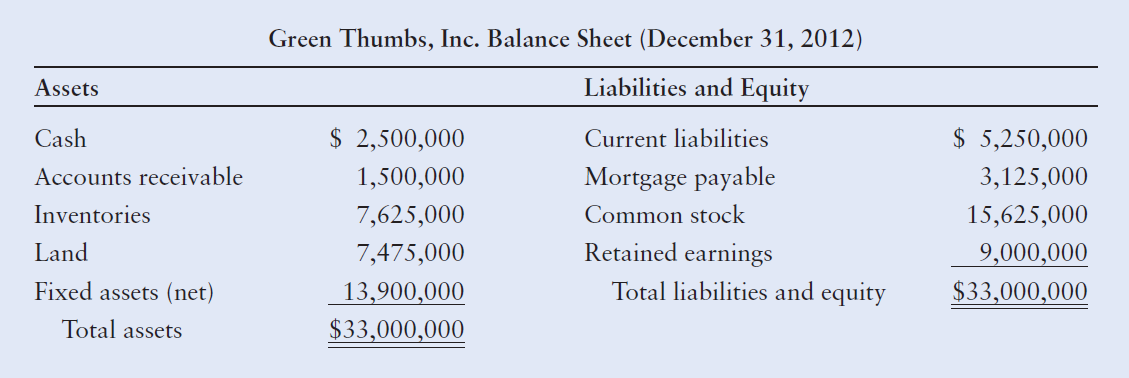

GTI’s majority owner and president, Herb Merrell, had reacted favorably and subsequently provided financial data, including GTI’s earnings record and current balance sheet. This data is presented in Tables 1 (below) and 2.

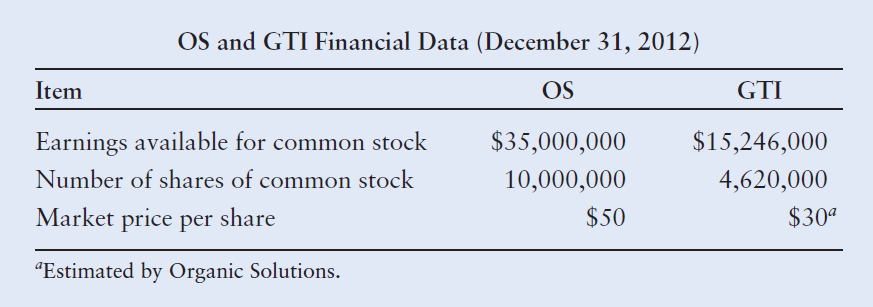

Jack Levine had estimated that the incremental cash inflow after taxes from the acquisition would be $18,750,000 for years 1 and 2; $20,500,000 for year 3; $21,750,000 for year 4; $24,000,000 for year 5; and $25,000,000 for years 6 through 30. He also estimated that the company should earn a rate of return of at least 16% on an investment of this type. Additional financial data for 2012 are given in Table 3.

Table 1

Table 2

Table 3

TO DO

a. What is the maximum price that Organic Solutions should offer GTI for a cash acquisition? (Note: Assume the relevant time horizon for analysis is 30 years.)

b. If OS planned to sell bonds to finance 80% of the cash acquisition price found in part a, how might issuance of each of the following bonds affect the firm?

Describe the characteristics and pros and cons of each bond:

(1) Straight bonds.

(2) Convertible bonds.

(3) Bonds with stock purchase warrants attached.

c. (1) What is the ratio of exchange in a stock swap acquisition if OS pays $30 per share for GTI? Explain why.

(2) What effect will this swap of stock have on the EPS of the original shareholders of (i) Organic Solutions and (ii) Green Thumbs, Inc.? Explain why.

(3) If the earnings attributed to GTI’s assets grow at a much slower rate than those attributed to OS’s premerger assets, what effect might this have on the EPS of the merged firm over the long run?

d. What other merger proposals could OS make to GTI’s owners?

e. What impact would the fact that GTI is actually a foreign-based company have on the foregoing analysis? Describe the added regulations, costs, benefits, and risks that are likely to be associated with such an international merger.

The word "distribution" has several meanings in the financial world, most of them pertaining to the payment of assets from a fund, account, or individual security to an investor or beneficiary. Retirement account distributions are among the most... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 978-0136119463

13th Edition

Authors: Lawrence J. Gitman, Chad J. Zutter