Question:

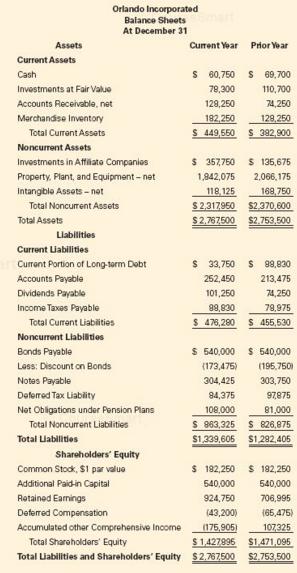

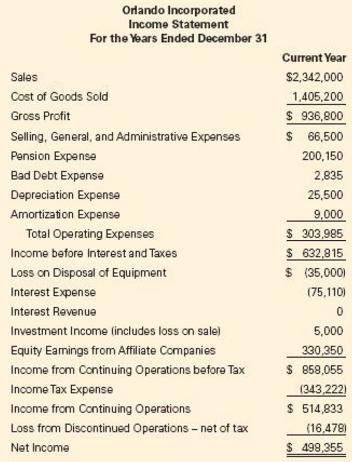

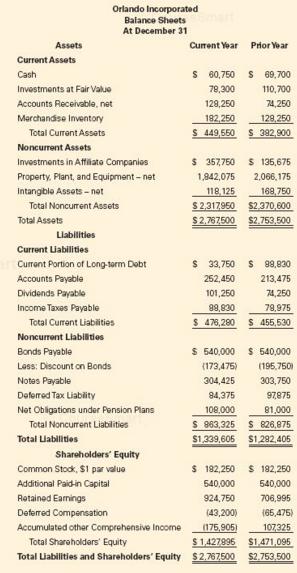

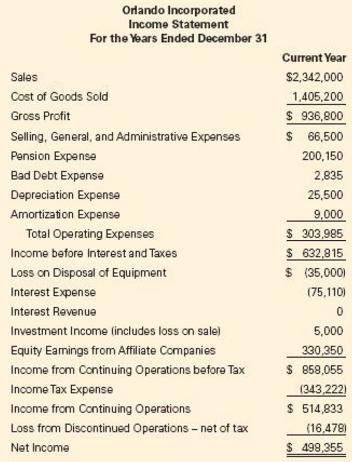

Orlando Incorporated pro-vided the following comparative balance sheets and the results of operations for the current year.

Additional Information:

1. O rlando sold investments with a cost of $ 74,250 at a loss of $ 14,250. It included this loss in investment income on the income statement.

2. O rlando acquired additional shares as investments to be carried at fair value. It accounted for all investments, other than investments carried under the equity method, as available-for-sale securities. It recorded a $ 6,000 unrealized loss for the current year.

3. O rlando reported accounts receivable net of the allowance for bad debts.

4. The company did not acquire additional plant and equipment during the year, but sold a piece of equipment with a cost of $ 198,600.

5. O rlando did not increase its percentage ownership of its equity investee (affiliate company). 6. O rlando sold one of its franchises at book value.

7. The company signed a $ 675 promissory note.

8. O rlando reported the loss from discontinued operations net of tax and as a cash transaction.

Required

Prepare the current-year cash flow statement for Orlando Incorporated under the indirect method. Present required disclosures.

Transcribed Image Text:

Orlando Incorporated Balance Sheets At December 31 Assets Current Year Prior Year Current Assets Cash Investments at Fair Value Accounts Receivable, net Marchandise Inventory s 60,750 69,700 7300 110,700 74,250 182 250 12250 S 449,650 S392,900 129,250 Total Current Assets Noncunent Assets Investments in Af ato Companies Property, Plant, and Equipment-net Intangble Assets-ot 357,750 135,675 42,075 2,066,175 118 125 169 7E0 S2.317950 $2370,600 Total Noncurrent Assets Total Assets 2.767500 $2.753.500 Liabilities Current Liabilities Current Portion of Long-torm Debt Accounts Payable Dividends Payable Income Taxes Payable s 33750 98.830 252,450 213,47 01,250 74,250 8883018.810 79,975 Total Curent Liablities Noncurent Liabilties Bonds Payable Loss: Discount on Bonds Notas Payable Deferred Tax Liablty Not Obigations under Pension Plans S 478.280 S 455.530 540000 540.000 173,475195,750 304425 303,750 4,375 97875 81,000 S 863325 S 826,875 $1,339,605 $1282,405 108,000 Total Noncurent Liabilities Total Liabilities Sharaholders Equity Comimon Stoc, $1 par value Additional Paid-in Capital Rotainod Earnings Deterred Compensation Accumulated othar Comprehensive Income (43,200 175,905 S 1,427996 Total Liabilities and Shareholders' Equity $2.267500 s 192,260 182,250 540,000 540,000 924,750706,99 (65,475) 107325 $1.471.095 $2753 500 Total Sharoholders' Equity Orlando Incorporated Income Statement For the ears Ended December 31 Sales Cost of Goods Sold Gross Proft Selling, General, and Administrative Expenses Pension Expense Bad Debt Expense Depreciation Expense Amortization Expense Current Year $2,342,000 1,405,200 S 936,800 S 66,500 200,150 2,835 25,500 9.000 Total Operating Expenses Income before Interest and Taxes Loss on Disposal of Equipment Interest Expense Interest Revenue Investment Income (includes loss on sale Equity Eamings from Affiliate Companies Income from Continuing Operations before Tax Income Tax Expense Income from Continuing Operations Loss from Discontinued Operations net of tax (16,478 Net Income $ 632,815 $ (35,000) (75,110) 5.000 330350 S 858,055 (343 222 514,833 $ 498.355