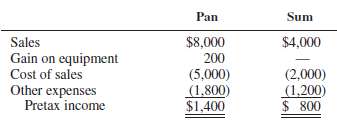

Pan Corporation and its 70 percent-owned subsidiary, Sum Corporation, have pretax operating incomes for 2011 as follows

Question:

Pan Corporation and its 70 percent-owned subsidiary, Sum Corporation, have pretax operating incomes for 2011 as follows (in thousands):

Pan received $280,000 dividends from Sum during 2011. A previously unrecorded patent from Pan's investment in Sum is being amortized at a rate of $50,000 per year (the same time horizon is used for both book and tax purposes).On January 1, 2011, Pan sold equipment to Sum at a $200,000 gain. Sum is depreciating the equipment at a rate of 20 percent per year. A flat 34 percent tax rate is applicable to both companies.REQUIRED:Prepare a consolidated income statement for Pan Corporation and Subsidiary for 2011. (Assume no deferred tax balance on January 1, 2011.)

Consolidated Income StatementWhen talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith