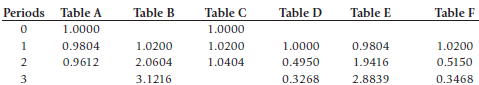

Part a. Reproduced in the following table are the first three lines from the 2% columns of

Question:

Part a. Reproduced in the following table are the first three lines from the 2% columns of each of several tables of mathematical values. For each of the following items, you are to select from among these fragmentary tables the one from which the amount required can be obtained most directly (assuming that the complete table was available in each instance):

1. The amount to which a single sum would accumulate at compound interest by the end of a specified period (interest compounded annually).

2. The amount that must be appropriated at the end of each of a specific number of years to provide for the accumulation, at annually compounded interest, of a certain sum.

3. The amount that must be deposited in a fund that will earn interest at a specified rate, compounded annually, in order to make possible the withdrawal of certain equal sums annually over a specified period starting one year from date of deposit.

4. The amount of interest that will accumulate on a single deposit by the end of a specified period (interest compounded semiannually).

5. The amount, net of compound discount, that if paid now would settle a debt of larger amount due at a specified future date.

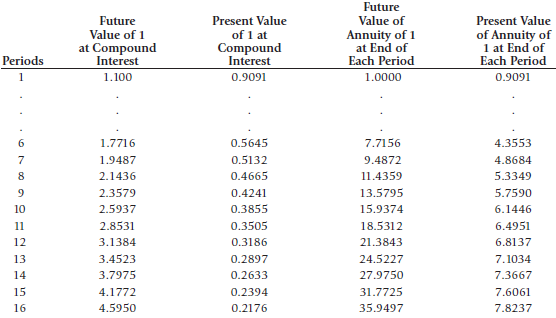

Part b. The following tables of values at 10% interest may be used as needed to answer the questions in this part of the problem.

1. Your client has made annual payments of $2,500 into a fund at the close of each year for the past three years. The fund balance immediately after the third payment totaled $8,275. He has asked you how many more $2,500 annual payments will be required to bring the fund to $22,500, assuming that the fund continues to earn interest at 10% compounded annually. Compute the number of full payments required and the amount of the final payment if it does not require the entire $2,500. Carefully label all computations supporting your answer.

2. Your client wishes to provide for the payment of an obligation of $200,000 due on July 1, 2014. He plans to deposit $20,000 in a special fund each July 1 for 7 years, starting July 1, 2008. He wishes to make an initial deposit on July 1, 2007 of an amount that, with its accumulated interest, will bring the fund up to $200,000 at the maturity of the obligation. He expects that the fund will earn interest at the rate of 10% compounded annually. Compute the amount to be deposited July 1, 2007. Carefully label all computations supporting youranswer.

Compound InterestCompound interest (or compounding interest) is interest calculated on the initial principal, which also includes all of the accumulated interest from previous periods on a deposit or loan. Thought to have originated in 17th century Italy, compound... Maturity

Maturity is the date on which the life of a transaction or financial instrument ends, after which it must either be renewed, or it will cease to exist. The term is commonly used for deposits, foreign exchange spot, and forward transactions, interest...

Step by Step Answer:

Intermediate Accounting

ISBN: 978-0324300987

10th Edition

Authors: Loren A Nikolai, D. Bazley and Jefferson P. Jones