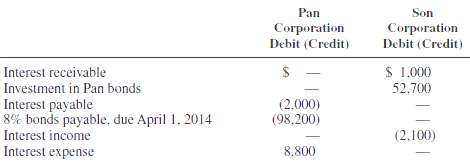

Partial adjusted trial balances for Pan Corporation and its 90 percent-owned subsidiary, Son Corporation, for the year

Question:

Partial adjusted trial balances for Pan Corporation and its 90 percent-owned subsidiary, Son Corporation, for the year ended December 31, 2011, are as follows:

Son Corporation acquired $50,000 par of Pan bonds on April 2, 2011, for $53,600. The bonds pay interest on April 1 and October 1 and mature on April 1, 2014.REQUIRED1. Compute the gain or loss on the bonds that will appear in the 2011 consolidated income statement.2. Determine the amounts of interest income and expense that will appear in the 2011 consolidated income statement.3. Determine the amounts of interest receivable and payable that will appear in the December 31, 2011, consolidated balance sheet.4. Prepare in general journal form the consolidation workpaper entries needed to eliminate the effects of the intercompany bonds for2011.

Consolidated Income StatementWhen talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith