Patton Services Company had the following transactions during the month of June:June 2. Issued Invoice No. 201

Question:

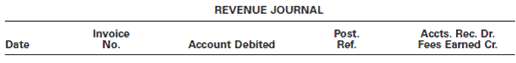

Patton Services Company had the following transactions during the month of June:June 2. Issued Invoice No. 201 to Thomas Corp. for services rendered on account, $290.3. Issued Invoice No. 202 to Mid States Inc. for services rendered on account, $410.12. Issued Invoice No. 203 to Thomas Corp. for services rendered on account, $145.22. Issued Invoice No. 204 to Parker Co. for services rendered on account, $605.28. Collected Invoice No. 201 from Thomas Corp.a. Prepare a revenue journal with the following headings to record the June revenue transactions for Patton Services Company.

b. What is the total amount posted to the accounts receivable control and fees earned accounts from the revenue journal for June?c. What is the June 30 balance of the Thomas Corp. customer account assuming a zero balance on June1?

Accounts ReceivableAccounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Accounting

ISBN: 978-0324662962

23rd Edition

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren