Paul Sabin organized Sabin Electronics 10 years ago to produce and sell several electronic devices on which

Question:

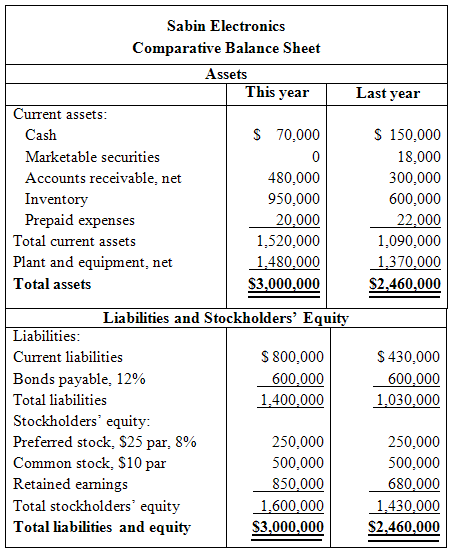

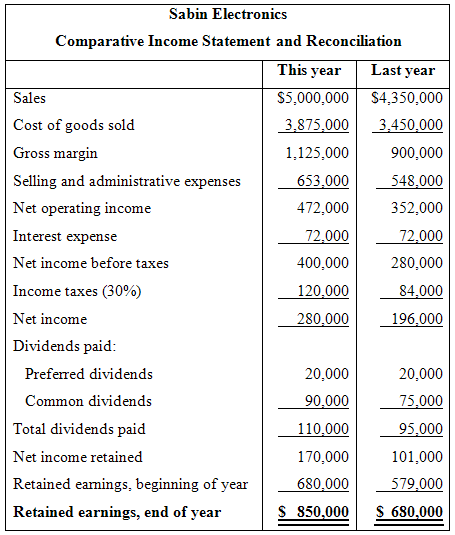

Paul Sabin organized Sabin Electronics 10 years ago to produce and sell several electronic devices on which he had secured patents. Although the company has been fairly profitable, it is now experiencing a severe cash shortage. For this reason, it is requesting a $500,000 long-term loan from Gulfport State Bank, $100,000 of which will be used to bolster the Cash account and $400,000 of which will be used to modernize equipment. The company’s financial statements for the two most recent years follow:

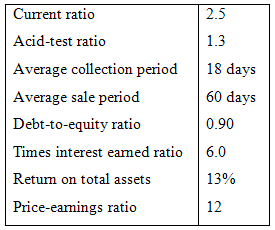

During the past year, the company introduced several new product lines and raised the selling prices on a number of old product lines in order to improve its profit margin. The company also hired a new sales manager, who has expanded sales into several new territories. Sales terms are 2/10, n/30. All sales are on account. Assume that the following ratios are typical of companies in the electronics industry:

Required:

1. To assist the Gulfport State Bank in making a decision about the loan, compute the following ratios for both this year and last year:

a) The amount of working capital.

b) The current ratio.

c) The acid-test ratio.

d) The average collection period. (The accounts receivable at the beginning of last year totaled $250,000.)

e) The average sale period. (The inventory at the beginning of last year totaled $500,000.)

f) The debt-to-equity ratio.

g) The times interest earned ratio.

2. For both this year and last year:

a) Present the balance sheet in common-size format.

b) Present the income statement in common-size format down through net income.

3. Comment on the results of your analysis in (1) and (2) above and make a recommendation as to whether or not the loan should be approved.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Managerial Accounting

ISBN: 978-0697789938

13th Edition

Authors: Ray H. Garrison, Eric W. Noreen, Peter C. Brewer