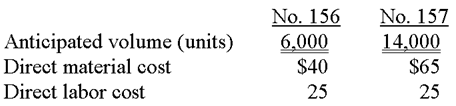

Pitney Corporation manufactures two types of transpondersno. 156 and no. 157and applies manufacturing overhead to all units

Question:

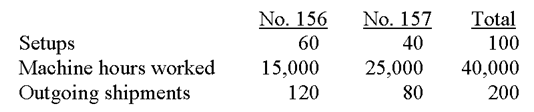

The controller, who is studying the use of activity-based costing, has determined that the firm's overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours worked, and outgoing shipments, the activities' three respective cost drivers, follow.

The controller, who is studying the use of activity-based costing, has determined that the firm's overhead can be identified with three activities: manufacturing setups, machine processing, and product shipping. Data on the number of setups, machine hours worked, and outgoing shipments, the activities' three respective cost drivers, follow.

The firm's total overhead of $3,060,000 is subdivided as follows: manufacturing setups, $260,000; machine processing, $2,400,000; and product shipping, $400,000.

Required:

A. Compute the pool rates that would be used for manufacturing setups, machine processing, and product shipping in an activity-based costing system.

B. Assuming use of activity-based costing, compute the unit overhead costs of product nos. 156 and 157 if the expected manufacturing volume is attained.

C. Assuming use of activity-based costing, compute the total cost per unit of product no. 156.

D. If the company's selling price is based heavily on cost, would a switch to activity-based costing from the current traditional system result in a price increase or decrease for product no. 156? Show computations.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Managerial Accounting Creating Value in a Dynamic Business Environment

ISBN: 978-0078025662

10th edition

Authors: Ronald Hilton, David Platt

Question Posted: