Presented below are selected accounts of Aramis Company at December 31, 2012. The following additional information is

Question:

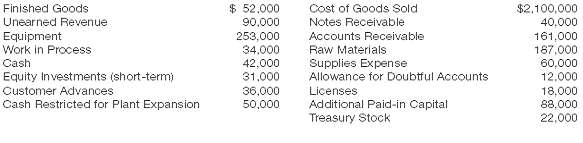

Presented below are selected accounts of Aramis Company at December 31, 2012.

The following additional information is available.1. Inventories are valued at lower-of-cost-or-market using LIFO.2. Equipment is recorded at cost. Accumulated depreciation, computed on a straight-line basis, is $50,600.3. The short-term investments have a fair value of $29,000. (Assume they are trading securities.)4. The notes receivable are due April 30, 2014, with interest receivable every April 30. The notes bear interest at 6%.5. The allowance for doubtful accounts applies to the accounts receivable. Accounts receivable of $50,000 are pledged as collateral on a bank loan.6. Licenses are recorded net of accumulated amortization of $14,000.7. Treasury stock is recorded at cost.InstructionsPrepare the current assets section of Aramis Company's December 31, 2012, balance sheet, with appropriatedisclosures.

Step by Step Answer: