Primrose Beauty Supplies Ltd. was incorporated in January 2016. Primrose had the following transactions in its first

Question:

Primrose Beauty Supplies Ltd. was incorporated in January 2016. Primrose had the following transactions in its first month:

Jan. 1 Received $150,000 in exchange for issuing 15,000 common shares.

1 Borrowed $100,000 from the local bank at 9%. The terms of the borrowing agreement state that the loan is to be repaid at the end of each month in the amount of $5,000 per month plus interest.

2 Leased a commercial warehouse, paying $8,000, of which $5,000 represented a damage deposit and

$3,000 was the rent for January.

8 Purchased nail art kits, one of Primrose€™s best selling product lines, costing $26,200 on account.

12 A chain of beauty salons paid Primrose a deposit of $6,500 related to a special order of hair products that were to be custom packaged under the salon€™s logo. Primrose agreed to deliver these products on February 15.

16 Recorded its sales of the first two weeks of the month. Total sales (half in cash and half on account) amounted to $18,200 and the inventory related to these sales was determined to have a cost of $9,200.

19 Paid the suppliers $7,000 for goods previously purchased on account.

25 Collections from customers on account totalled $7,100.

31 Made the loan payment required under the terms of the borrowing agreement.

Required:

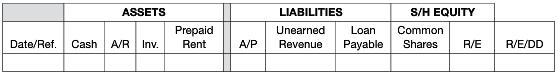

Analyze and record these transactions using the template method.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 978-1118849385

1st Canadian Edition

Authors: Christopher Burnley, Robert Hoskin, Maureen Fizzell, Donald