A problem often discussed in the engineering economy literature is the oil-well pump problem} Pump 1is a

Question:

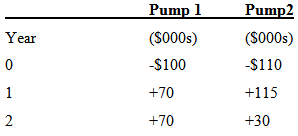

A problem often discussed in the engineering economy literature is the "oil-well pump problem"} Pump 1is a small pump; Pump 2 is a larger pump that costs more, will produce slightly more oil, and will produce it more rapidly. If the MARR is 20%, which pump should be selected? Assume that any temporary external investment of money earns 10% per year and that any temporary financing is done at 6%. } One of the more interesting exchanges of opinion about this problem is in Prof. Martin Wahl’s "Common

Misunderstandings About the Internal Rate of Return and Net Present Value Economic Analysis Methods;" and the associated discussion by Professors Winfrey, Leavenworth, Steiner, and Bergmann, published in Evaluating Transportation Proposals, Transportation Research Record 731, Transportation Research Board, Washington, D.C. See also Appendix 7A in Chapter 7.

What is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Internal Rate of Return

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment... MARR

Minimum Acceptable Rate of Return (MARR), or hurdle rate is the minimum rate of return on a project a manager or company is willing to accept before starting a project, given its risk and the opportunity cost of forgoing other...

Step by Step Answer: