Profitability of order, opportunity cost, and capacity Hudson Hydronics, Inc., is a corporation based in Troy, New

Question:

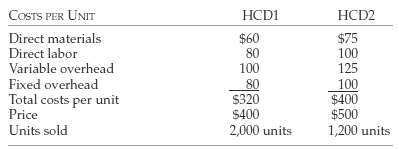

Profitability of order, opportunity cost, and capacity Hudson Hydronics, Inc., is a corporation based in Troy, New York, that sells high-quality hydronic control devices. It manufactures two products, HCD1 and HCD2, for which the following information is available:

The average wage rate including fringe benefits is $20 per hour. The plant has a capacity of 15,000 direct labor hours, but current production uses only 14,000 direct labor hours of capacity. Hudson can, if desired, hire additional direct labor up to its capacity of 15,000 direct labor hours.Required(a) A new customer has offered to buy 200 units of HCD2 if Hudson lowers its price to $400 per unit. How many direct labor hours will be required to produce 200 units of HCD2? How much will Hudson Hydronic's profit increase or decrease if it accepts this proposal? (Assume all other prices will remain as before.)(b) Suppose the customer has offered instead to buy 300 units of HCD2 at $400 per unit. How much will the profits increase or decrease if Hudson accepts this proposal? Assume that the company cannot increase its production capacity beyond 15,000 direct labor hours.(c) Answer the question in part b assuming that the plant can work overtime. Direct labor costs for the overtime production increase to $30 per hour. Variable overhead costs for overtime production are 50% more than for normalproduction.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Management Accounting Information for Decision-Making and Strategy Execution

ISBN: 978-0137024971

6th Edition

Authors: Anthony A. Atkinson, Robert S. Kaplan, Ella Mae Matsumura, S. Mark Young