Pug Corporation acquired a 70 percent interest in Sat Corporation for $238,000 on January 2, 2010, when

Question:

Pug Corporation acquired a 70 percent interest in Sat Corporation for $238,000 on January 2, 2010, when Sat's equity consisted of $200,000 capital stock and $50,000 retained earnings. The excess is due to a patent amortized over a 10-year period, at $9,000 per year. Pug accounted for its investment in Sat during 2010 as follows:

Investment cost January 2, 2010 ......... $238,000

Income from Sat [($40,000 - $9,000) * 70%] ..... 21,700

Dividends from Sat ($20,000 * 70%) ...... (14,000)

Investment balance December 31, 2010 ..... $245,700

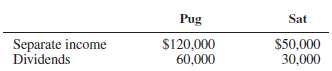

On January 3, 2011, Sat acquired a 10 percent interest in Pug at a $60,000 fair value equal to book value. No intercompany profit transactions have occurred. Incomes and dividends for 2011 were as follows:

REQUIRED1. Determine the balance of Pug's Investment in Sat account on December 31, 2011, if the treasury stock approach is used for Sat's investment in Pug.2. Compute controlling and noncontrolling interest shares of consolidated net income if the conventional approach is used for Sat's investment in Pug. Also determine the amount of Pug's income from Sat and the balance in Pug's Investment in Sat account at December 31, 2011.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith