Pun Corporation recognizes a deferred tax asset (benefit) of $150,000 related to its acquisition of Sew Company.

Question:

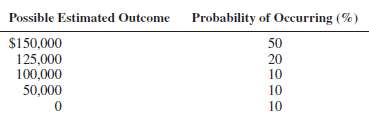

Pun Corporation recognizes a deferred tax asset (benefit) of $150,000 related to its acquisition of Sew Company. Pun has determined that the tax position qualifies for recognition and should be measured. Pun has determined the amounts and the probabilities of the possible outcomes, as follows:

REQUIRED: Calculate the tax benefit to be recognized by Pun.

CorporationA Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Advanced Accounting

ISBN: 9780132568968

11th Edition

Authors: Floyd A. Beams, Joseph H. Anthony, Bruce Bettinghaus, Kenneth Smith

Question Posted: