Refer to Exhibit. Assume that you are a consultant who has been hired by Sun coast Food

Question:

Refer to Exhibit. Assume that you are a consultant who has been hired by Sun coast Food Centers,

Required:

Write a memorandum to the company president explaining why the ROI based on net book value (in Exhibit) behaves as it does over the five-year time horizon.

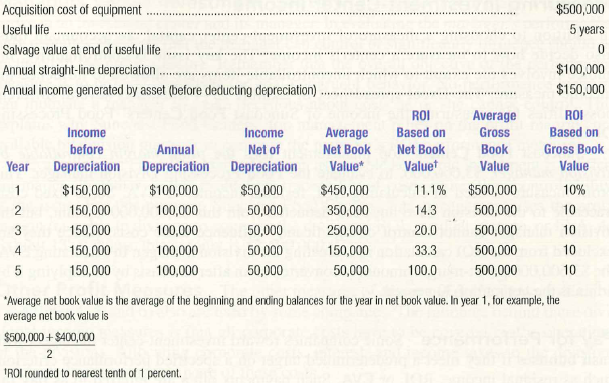

$500,000 Acquisition cost of equipment 5 years Useful life Salvage value at end of useful life Annual straight-line depreciation.. $100,000 $150,000 Annual income generated by asset (before deducting depreciation) ROI Average ROI Average Income Based on Gross Based on Income before Annual Net Book Net Book Book Gross Book Net of Depreciation Value* Valuet Value Value Year Depreciation Depreciation $50,000 $150,000 $100,000 $450,000 11.1% $500,000 10% 1 150,000 100,000 50,000 350,000 14.3 500,000 10 150,000 100,000 50,000 250,000 20.0 500,000 10 150,000 100,000 50,000 150,000 33.3 500,000 10 500,000 150,000 100,000 50,000 50,000 100.0 10 "Average net book value is the average of the beginning and ending balances for the year in net book value. In year 1, for example, the average net book value is $500,000 + $400,000 IROI rounded to nearest tenth of 1 percent.

Step by Step Answer:

Memorandum Date Today To President Sun Coast Food Centers From I ...View the full answer

Related Video

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. An example of fixed assets are buildings, furniture, office equipment, machinery, etc. The land is the only exception that cannot be depreciated as the value of land appreciates with time. Depreciation allows a portion of the cost of a fixed asset to be the revenue generated by the fixed asset. This is mandatory under the matching principle as revenues are recorded with their associated expenses in the accounting period when the asset is in use. This helps in getting a complete picture of the revenue

Students also viewed these Accounting questions

-

You are a consultant who has been hired to improve the effectiveness of corporate trainers. These trainers frequently make presentations to employees on topics such as conflict management, teamwork,...

-

Assume that you are a consultant to Morton Inc. and you have been provided with the following data: D1 = $1.00; P0 = $25.00; and g = 6% (constant). What is the cost of equity from retained earnings...

-

Assume that you are a consultant to firms with new products. You have members of the appropriate market segments rate innovations on the 10 characteristics described in Table 7-3. Based on these...

-

1. Construct a simple pendulum starting with 20 cm length. 2. Hang the pendulum as pictures in one of the two methods shown above. 3. Using the protractor, displace the pendulum 10 degrees from the...

-

Show that (()()) is a balanced string of parentheses and (())) is not a balanced string of parentheses.

-

Cast Inc. is finding that its employees are switching to defined contribution plans by forfeiting their defined benefit plans. Cast Inc. has been able to measure the actuarial present value of this...

-

Now, continue developing your Gantt chart with the rest of the information contained in the table in Exercise 10.19, and create a complete activity network diagram for this project.

-

Cost and production data for Binghamton Beverages Inc. are presented as follows: Required: 1. a. Calculate net variances for materials, labor, and factory overhead. b. Calculate specific materials...

-

Farrina Manufacturing uses a predetermined overhead application rate of $8 per direct labor hour. A review of the company's accounting records for the year just ended discovered the following:...

-

The graph below displays the sample sizes and percentages of people in different age and gender groups who were polled concerning their approval of Mayor Ford's actions in office. The total number in...

-

Wyalusing Industries has manufactured prefabricated houses for over 20 years. The houses are constructed in sections to be assembled on customers lots. Wyalusing expanded into the precut housing...

-

Dryden Company is an auto parts supplier. At the end of each month, the employee who maintains all of the inventory records takes a physical inventory of the firms stock. When discrepancies occur...

-

Are taxes the most important consideration in global location decisions? If not, how should these decisions be made?

-

Solve the following linear system by Gaussian elimination with back-substitution without introducing fractions in your row-reduction. If there is no solution, explain why. -3x+8y + 82 = -8 -2x+ y -...

-

Introduction Some predictions are a slam dunk. Retail will continue to be driven by technology. Science fiction is coming to life in the form of robotics and virtual reality. And the Internet will...

-

Oswego Clay Pipe Company provides services of $ 5 0 , 0 0 0 to Southeast Water District # 4 5 on April 1 2 of the current year with terms 1 / 1 5 , n / 6 0 . What would Oswego record on April 1 2 ?...

-

Assume the following excerpts from a company's balance sheet: Property, plant, and equipment Beginning Balance $3,500,000 Ending Balance $3,700,000 $1,100,000 $800,000 Long-term investments During...

-

On January 1, 2021, Bonita Corp. had472,000shares of common stock outstanding. During 2021, it had the following transactions that affected the Common Stock account. February 1 Issued 125,000shares...

-

Dividends. CEO Davidson knows the firm is falling into a financial black hole but refuses to reduce the dividend. Why is he being so stubborn? Is there any reason why he could be correct in his...

-

Show, if u(x, y) and v(x, y) are harmonic functions, that u + v must be a harmonic function but that uv need not be a harmonic function. Is e"e" a harmonic function?

-

Identify dimensions of supplier performance that affect total cost.

-

Explain the meaning of (a) Differential revenue, (b) Differential cost, and (c) Differential income.

-

Explain the meaning of (a) Differential revenue, (b) Differential cost, and (c) Differential income.

-

A company could sell a building for $250,000 or lease it for $2,500 per month. What would need to be considered in determining if the lease option would be preferred?

-

The company sold merchandise to a customer on March 31, 2020, for $100,000. The customer paid with a promissory note that has a term of 18 months and an annual interest rate of 9%. The companys...

-

imer 2 0 2 4 Question 8 , PF 8 - 3 5 A ( similar to ) HW Score: 0 % , 0 of 1 0 0 points lework CH 8 Part 1 of 6 Points: 0 of 1 5 Save The comparative financial statements of Highland Cosmetic Supply...

-

An investor wants to purchase a zero coupon bond from Timberlake Industries today. The bond will mature in exactly 5.00 years with a redemption value of $1,000. The investor wants a 12.00% annual...

Study smarter with the SolutionInn App