Question:

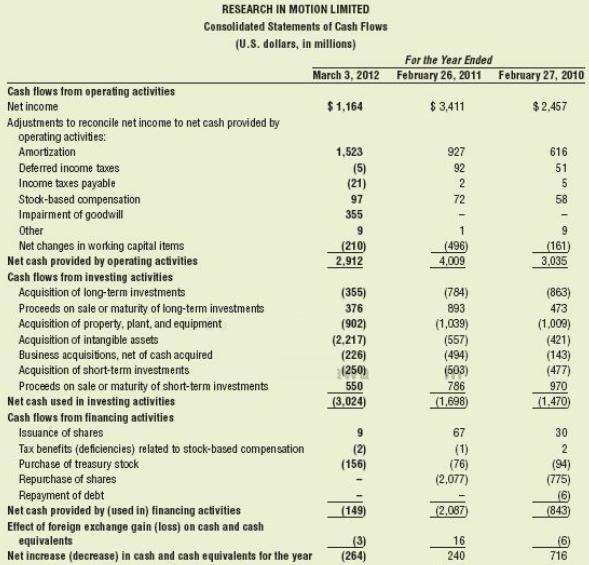

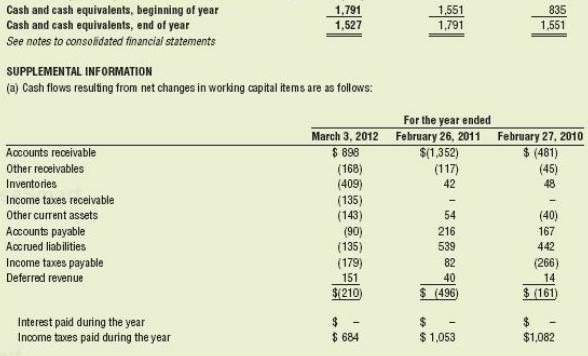

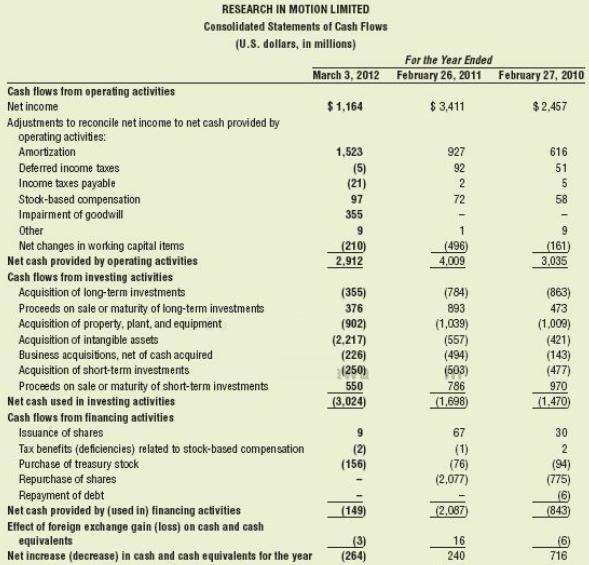

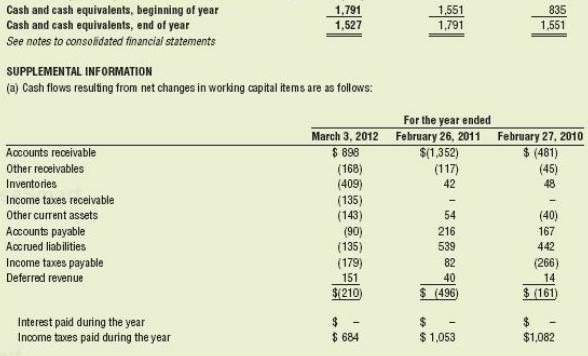

Research In Motion (RIM) (now called Blackberry) is a leading designer, manufacturer, and marketer of innovative wireless solutions for the worldwide mobile communications market. Its products are used around the world and include the BlackBerry wireless platform, software development tools, and software/ hardware licensing agreements. RIM's statement of cash flows for fiscal years 2012, 2011, and 2010 are shown on the next page.

Required:

1. Have RIM's

accounts receivable increased or decreased during fiscal year 2012? By how much have its

accounts receivable changed during the past three years? Explain.

2. How does the change in inventory during fiscal year 2012 affect cash? Explain.

3. What conclusions can you derive by examining the pattern of the company's cash flows during these three years?

4. How did the company finance the acquisition of non- current assets during fiscal years 2011 and 2012? Explain.

5. What additional information does the statement of cash flows provide that is not available on either the statement of financial position or the statement of earnings?

Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Transcribed Image Text:

RESEARCH IN MOTION LIMITED Consolidated Statements of Cash Flows (U.S. dollars, in millions) For the Year Ended March 3, 2012 February 26, 2011 February 27, 2010 Cash flows from operating activities Net income $1,164 $ 3,411 $2,457 Adjustments to reconcile net income to net cash provided by operating activities: Amortization 1,523 927 616 Deferred income taves (5) (21) 92 51 Income taxes payable Stock-based compensation Impairment of goodwill 97 72 58 355 Other (496) 4,009 (161) 3,035 Net changes in working capital items Net cash provided by operating activities Cash flows from investing activities Acquisition of long-term investments Proceeds on sale or maturity of long-term investments Acquisition of property, plant, and equipment Acquisition of intangible assets Business acquisitions, net of cash acquired (210) 2,912 (355) (784) (863) 376 893 473 (902) (2,217) (226) (250) (1,039) (557) (494) (503) (1,009) (421) (143) (477) 970 (1,470 Acquisition of short-term investments Proceeds on sale or maturity of short-term investments Net cash used in investing activities Cash flows from financing activities 550 786 (3,024) (1,698) Issuance of shares 67 30 Tax benefits (deficiencies) related to stock-based compensation Purchase of treasury stock Repurchase of shares Repayment of debt Net cash provided by (used in) financing activities (1) (76) (2,077) (156) (94) (775) (149) (2,087) (843) Effect of foreign exchange gain (loss) on cash and cash equivalents Net increase (decrease) in cash and cash equivalents for the year (3) (264) 16 240 716