ROI, RI, division managers compensation, balanced scorecard. Key information for the Peoria Division (PD) of Barrington Industries

Question:

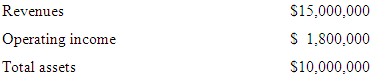

ROI, RI, division manager’s compensation, balanced scorecard. Key information for the Peoria Division (PD) of Barrington Industries for 2009 follows.

PD’s managers are evaluated and rewarded on the basis of ROI defined as operating income divided by total assets. Barrington Industries expects its divisions to increase ROI each year

Next year, 2010, appears to be a difficult year for PD. PD had planned a new investment to improve quality but in view of poor economic conditions, has postponed the investment. ROI for 2010 was certain to decrease if PD had made the investment Management is now considering ways to meet its target ROI of 20% for next year. It anticipates revenues to be steady at $15,000,000 in 2010.

1. Calculate PD’s return on sales (ROS) and ROI for 2009.

2. a. By how much would PD need to cut costs in 2010 to achieve its target ROI of 20%, assuming no change in total assets between 2009 and 2010?

b. By how much would PD need to decrease total assets in 2010 to achieve its target ROI of 20%, assuming no change in operating income between 2009 and 2010?

3. Calculate PD’s RI in 2009 assuming a required rate of return on investment of 15%.

4. PD wants to increase RI by 50% in 2010. Assuming it could cut costs by $45,000 in 2010, by how much would PD need to decrease total assets in 2010?

5. Barrington Industries is concerned that the focus on cost cutting, asset sales and no new investments will have an adverse long-run effect on PD’s customers. Yet Barrington wants PD to meet its financial goals. What other measurements, if any, do you recommend that Barrington use? Explain briefly.

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav