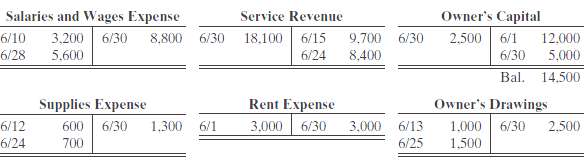

Selected accounts for Brianna??s Salon are presented below. All June 30 postings are from closing entries.Instructions(a) Prepare

Question:

Selected accounts for Brianna??s Salon are presented below. All June 30 postings are from closing entries.Instructions(a) Prepare the closing entries that were made.(b) Post the closing entries to IncomeSummary.

Transcribed Image Text:

Owner's Capital 12.000 5.000 Salaries and Wages Expense 3,200 6/30 Service Revenue 8,800 6/30 18.100 6/15 6/24 8,400 9,700 6/30 2.500 6/1 6/10 6/30 Bal. 14.500 5.600 6/28 Supplies Expense Rent Expense Owner's Drawings 2,500 6/30 1.300 6/30 3,000 6/13 6/25 3,000 1.000 1.500 6/30 600 6/1 6/24 700

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 47% (17 reviews)

a June 30 Service Revenue 18100 Income Summary 18100 30 Income Summar...View the full answer

Answered By

Emel Khan

I have the ability to effectively communicate and demonstrate concepts to students. Through my practical application of the subject required, I am able to provide real-world examples and clarify complex ideas. This helps students to better understand and retain the information, leading to improved performance and confidence in their abilities. Additionally, my hands-on approach allows for interactive lessons and personalized instruction, catering to the individual needs and learning styles of each student.

5.00+

2+ Reviews

10+ Question Solved

Related Book For

Accounting Principles

ISBN: 978-0470534793

10th Edition

Authors: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Question Posted:

Students also viewed these Accounting questions

-

Selected accounts for Nina??s Salon are presented below. All June 30 postings are from closing entries. Instructions(a) Prepare the closing entries that were made.(b) Post the closing entries to...

-

Selected accounts for Tamoras Salon are presented below. All June 30 postings are from closing entries. Instructions (a) Prepare the closing entries that were made. (b) Post the closing entries to...

-

Selected accounts for Tamoras Salon are presented below. All June 30 postings are from closing entries. Instructions a. Prepare the closing entries that were made. b. Post the closing entries to...

-

In Problems 530, a. Classify the sequences as arithmetic, geometric, Fibonacci, or none of these. b. If arithmetic, give d; if geometric, give r; if Fibonacci, give the first two terms; and if none...

-

Summarize the advantages of being a first mover.

-

In your job in the receiving department of a business, you are responsible for verifying the accuracy of a shipment. What do you do?

-

(continuation of 9.18) A year later, Bonzo Oil experienced a 25 percent decline in the sales of its products and no longer accepts its full shipments of the refinery outputs. Accordingly, Bonzo seeks...

-

On April 1, 2011, Bay delivers merchandise to Ram for 200,000 pesos when the spot rate for pesos is 6.0496 pesos. The receivable from Ram is due May 30. Also on April 1, Bay hedges its foreign...

-

33 Which among the following is a suitable equation for calculating depreciation? d Out of o a. Cost of the assets + residual value / useful life b. Cost of the asset - residual value / useful life...

-

Consider the following regression output: Y i = 0.2033 + 0.6560X t se = (0.0976) (0.1961) r 2 = 0.397 RSS = 0.0544 ESS = 0.0358 where Y = labor force participation rate (LFPR) of women in 1972 and X...

-

Vince Vance has prepared the following list of statements about the accounting cycle. 1. Journalize the transactions is the first step in the accounting cycle. 2. Reversing entries are a required...

-

JMorcus Webb Company discovered the following errors made in January 2012. 1. A payment of Salaries and Wages Expense of $700 was debited to Equipment and credited to Cash, both for $700. 2. A...

-

How might a company benefit by sharing its own internal budget information with other companies? LO1

-

2 4 . In the current year, Madison sold Section 1 2 4 5 property for $ 6 , 0 0 0 . The property cost $ 2 6 , 0 0 0 when it was purchased 5 years ago. The depreciation claimed on the property was $ 2...

-

Swifty Company purchased machinery on January 1, 2025, for $82,400. The machinery is estimated to have a salvage value of $8,240 after a useful life of 8 years. (a) Your answer is incorrect. Compute...

-

Currently, the unit selling price is $ 5 0 , the variable cost is $ 3 4 , and the total fixed costs are $ 1 0 8 , 0 0 0 . a . Compute the current break - even sales in units.

-

(1) The Mean Value Theorem states: Let f be continuous over the closed [a, b] and differentiable over the open interval (a, b). Then, there exists at least one point c E (a, b) such that: f(b) - f(a)...

-

Assume you are an Israeli investor; the symbol for the Israeli currency, the shekel, is ILS. You see that stock for Top Image has a bid price of ILS 17 and an ask price of ILS 19 in Israel, a bid...

-

There lilfcm any diff~ttnl ways in wh1dl liLrgcc o.rporil.tionas n lnilUl:!:nt' he political S)St~m: (a) Rc\otvlngdoor: lndus.try repr1?:Senlallvbee:sc ome regulator~ and via versa.. (b) Dlr

-

Determine the volume of the parallelepiped of Fig. 3.25 when (a) P = 4i 3j + 2k, Q = 2i 5j + k, and S = 7i + j k, (b) P = 5i j + 6k, Q = 2i + 3j + k, and S = 3i 2j + 4k. P

-

A study by researchers at Stanford and the University of Chicago discovered that most of the people who quit their jobs and start their own business do so not because they have a billion-dollar idea...

-

Assume the same information as BE10-15, except that the fair market value of the old delivery equipment is $38,000. Prepare the entry to record the exchange.

-

African Lakes Company purchased a delivery truck. The total cash payment was $27,900, including the following items. Negotiated purchase price....... $24,000 Installation of special shelving........

-

On January 1, 2010, Pine Grove Country Club purchased a new riding mower for $15,000.The mower is expected to have an 8-year life with a $1,000 salvage value . What journal entry would Pine Grove...

-

Be prepared to explain the texts comprehensive To illustrate the issues related to interest capitalization, assume that on November 1, 2016, Shalla Company contracted Pfeifer Construction Co. to...

-

On April 1, 2020. Indigo Company received a condemnation award of $473,000 cash as compensation for the forced sale of the company's land and building, which stood in the path of a new state highway....

-

The market price of a stock is $24.55 and it is expected to pay a dividend of $1.44 next year. The required rate of return is 11.23%. What is the expected growth rate of the dividend? Submit Answer...

Study smarter with the SolutionInn App