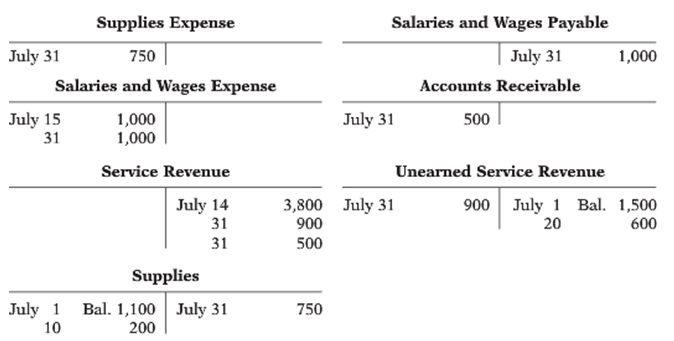

Selected accounts of Castle Company are shown here. Instructions After analyzing the accounts, journalize (a) The July

Question:

Selected accounts of Castle Company are shown here.

Instructions

After analyzing the accounts, journalize

(a) The July transactions and

(b) The adjusting entries that were made on July 31.

Salaries and Wages Payable Supplies Expense July 31 July 31 1,000 750 Salaries and Wages Expense Accounts Receivable July 15 31 1,000 1,000 July 31 500 Unearned Service Revenue Service Revenue 900 July 1 Bal. 1,500 20 July 14 31 3,800 July 31 900 500 600 31 Supplies Bal. 1,100 July 31 200 July 1 750 10

Step by Step Answer:

a July 10 Supplies 200 Cash 200 14 Cash 3800 Service Revenue 3800 15 Salaries and ...View the full answer

Accounting Tools for Business Decision Making

ISBN: 978-1118128169

5th edition

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

Related Video

Unearned revenue is money received by an individual or company for a service or product that has yet to be provided or delivered. It can be thought of as a \"prepayment\" for goods or services that a person or company is expected to supply to the purchaser at a later date. As a result of this prepayment, the seller has a liability equal to the revenue earned until the good or service is delivered. This liability is noted under current liabilities, as it is expected to be settled within a year.

Students also viewed these Accounting questions

-

A lease agreement that qualifies as a finance lease calls for annual lease payments of $50,000 over a six-year lease term (also the asset's useful life), with the first payment at January 1, the...

-

Mullins Real Estate received a check for A30,000 on July 1 which represents a 6-month advance payment of rent on a building it rents to a client. Unearned Rent Revenue was credited for the full...

-

Journalize the following adjusting entries that were included on the work sheet for the month ended December 31. Dec. 31 Salaries for three days are unpaid at December 31, $ 2,700. Salaries are $...

-

GoFast Corp. wishes to renovate the property so that he can sell it at a higher price.The after-tax cash flow over next year up to RM320,000 if the property was renovated.The renovation cost is...

-

Are some cities more windy than others? Does Chicago deserve to be nicknamed "The Windy City"? These data are the average wind speeds (in miles per hour) for 54 selected cities in the United States:...

-

Michael Mosely works as a purchasing agent for Suharto Coal Supply, a partnership. Mosely has authority to purchase the coal needed by Suharto to satisfy the needs of its customers. While Mosely is...

-

9. To answer this question, use the assumptions of Example 1 and the risk-neutral valuation method (and risk-neutral probability) described in Example 2. a. Compute the value of a claim that pays the...

-

The Bayview Resort has three operating departmentsthe Convention Center, Food Services, and Guest Lodgingthat are supported by three service departments General Administration, Cost Accounting, and...

-

Comm Devices (CD) is a division of Worldwide Communications, Inc. CD produces restaurant pagers and other personal communication devices. These devices are sold to other Worldwide divisions, as well...

-

Recently, Ashland MultiComm Services has been criticized for its inadequate customer service in responding to questions and problems about its telephone, cable television, and Internet services....

-

A partial adjusted trial balance for Barone Company is given in E4-13. Instructions Prepare the closing entries at January 31, 2014.

-

The trial balances shown below are before and after adjustment for Bere Company at the end of its fiscal year. Instructions Prepare the adjusting entries that weremade. BERE COMPANY Trial Balance...

-

The Hastings Sugar Corporation has the following pattern of net income each year, and associated capital expenditure projects. The firm can earn a higher return on the projects than the stockholders...

-

Home Base, Incorporated reports the following production cost information: Units produced 97,000 units Units sold 92,000 units Ending finished goods inventory 5,000 units Direct labor $17 per unit...

-

About New York City public sector finance. The other way is to delineate the problem. We should use data to show a problem, and then analyze the environment in which budgeting takes place to suggest,...

-

From a survey a company has determined that 23% of its customers are classified as "advocates" , 68% as "passives" and the remainder as "detractors" . Research suggests that during a year 15% of the...

-

The following are the transactions of Spotlighter, Incorporated, for the month of January. a. Borrowed $3,940 from a local bank on a note due in six months. b. Received $4,630 cash from investors and...

-

1. What are the deeper problems that plague in different forms it takes throughout the world according to the authors? Please, briefly explain. 2. Why was Joseph Schumpeter a pessimist about the...

-

(a) Provide a definition of the deprival value of an asset. (2 marks) (b) For a particular asset, suppose the three bases of valuation relevant to the calculation of its deprival value are (in...

-

Federated Shipping, a competing overnight delivery service, informs the customer in Problem 65 that they would ship the 5-pound package for $29.95 and the 20-pound package for $59.20. (A) If...

-

Using the natural rate of unemployment to predict changes in inflation The estimated Phillips curve from Figure 8.4 is \[ \pi_{t}-\pi_{t-1}=3.0-0.5 u_{t} \] Fill in the table below using the data...

-

At December 31, 2012, the trial balance of Oliker Company contained the following amounts before adjustment. Instructions(a) Prepare the adjusting entry at December 31, 2012, to record bad debts...

-

A On January 1, 2012, Sather Company had Accounts Receivable of $54,200 and Allowance for Doubtful Accounts of $3,700. Sather Company prepares financial statements annually. During the year, the...

-

The president of Screven Enterprises asks if you could indicate the impact certain transactions have on the following ratios. 1. Received $5,000 on cash sale. The cost of the goods sold was $2,600.2....

-

If John invested $20,000 in a stock paying annual qualifying dividends equal to 4% of his investment, what would the value of his investment be 5 years from now? Assume Johns marginal ordinary tax...

-

help asap please!

-

Please, help asap! I have one day. Feedback will be given. & show some work. [in Excel] For the final project you will need you to create a spreadsheet /proforma of the cash flows from a property....

Study smarter with the SolutionInn App