Shonda receives dividend income from the following foreign and domestic corporations in the current tax year. Determine

Question:

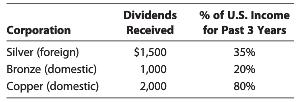

Shonda receives dividend income from the following foreign and domestic corporations in the current tax year.

Determine the amount of U.S.-sourced income for each corporation.

Transcribed Image Text:

Corporation Silver (foreign) Bronze (domestic) Copper (domestic) Dividends Received $1,500 1,000 2,000 % of U.S. Income for Past 3 Years 35% 20% 80%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 61% (13 reviews)

Because Bronze Corporation and Copper Corporation are domestic corporations the di...View the full answer

Answered By

Akshay Agarwal

I am a Post-Graduate with a specialization in Finance. I have been working in the Consulting industry for the past 8 years with a focus on the Corporate and Investment Banking domain. Additionally, I have been involved in supporting student across the globe in their academic assignments and always strive to provide high quality support in a timely manner. My notable achievements in the academic field includes serving more than 10,000 clients across geographies on various courses including Accountancy, Finance, Management among other subjects. I always strive to serve my clients in the best possible way ensuring high quality and well explained solutions, which ensures high grades for the students along-with ensuring complete understanding of the subject matter for them. Further, I also believe in making myself available to the students for any follow-ups and ensures complete support and cooperation throughout the project cycle. My passion in the academic field coupled with my educational qualification and industry experience has proved to be instrumental in my success and has helped me stand out of the rest. Looking forward to have a fruitful experience and a cordial working relationship.

5.00+

179+ Reviews

294+ Question Solved

Related Book For

South Western Federal Taxation 2018 Corporations Partnerships Estates And Trusts

ISBN: 1389

41st Edition

Authors: William H. Hoffman, William A. Raabe, James C. Young, Annette Nellen, David M. Maloney

Question Posted:

Students also viewed these Business Law questions

-

Determine Ronas gross income from the following items she receives during the current year: Interest on savings account ....... $ 300 Dividends on Microsoft stock ........ 200 Interest on Guam...

-

For which of the following foreign income inclusions is a U.S. corporation potentially allowed an indirect FTC under 902? a. Interest income from a 5% owned foreign corporation. b. Interest income...

-

The Boo-Ball Corporation receives dividend income of $200,000 from Flew-Ball, a domestic corporation. Boo-Ball owns 70% of Flew-Ball. Boo-Balls net income from operations is $50,000. What is...

-

Consider the following population regression model: y = Bo + Bx + Bx2 + 3x3 + u Suppose you want to test whether 0.532 = 83. The hypotheses are: Ho : 0.582 = 33 H : 0.532 #33 The correct expression...

-

What are some other types of health insurance that might be offered by an employer?

-

What are the limitations of closed questions?

-

Boiler drum production. In a production facility, an accurate estimate of man-hours needed to complete a task is required. A manufacturer of boiler drums used regression to predict the number of...

-

Mr. Lion, who is in the 37 percent tax bracket, is the sole shareholder of Toto, Inc., which manufactures greeting cards. Totos average annual net profit (before deduction of Mr. Lions salary) is...

-

PL Transactions The selected transactions below were completed by Cote Delivery Service during July: Indicate the effect of each transaction on the accounting equation by choosing the appropriate...

-

It is late 2019, and you are a successful executive working in New York for a large company. Tomorrow morning you will have the opportunity to negotiate receiving a $100,000 bonus at the end of the...

-

Draft a short speech that you will give to your university's Business Club. The title of your talk is "What Is Worldwide Taxation and How Can I Avoid It?"

-

Cordeio, Inc. is a CFC for the entire tax year. Vancy Company, a U.S. corporation, owns 75% of Cordeio's one class of stock for the entire year. Subpart F income is $450,000, and no distributions...

-

You are seeding a triangular courtyard. One side of the courtyard is 52 feet long and another side is 46 feet long. The angle opposite the 52-foot side is 65. (a) Draw a diagram that gives a visual...

-

Answer the following problems with solution: Use the following information for the next two questions: The statement of financial position of the partnership of A and B as of December 31, 20x1 is...

-

Complete the following budgets 1 Production Budget Planned Sales Desired Ending Inventory of Finished Goods (roundup to the next unit) Total Needed Less: Beginning Inventory Total Production {7.01}

-

Solution needs urgently. Question 1 (5 points) In times of prosperity (with high incomes and employment), governments at all levels have resources for high cost infrastructure such as roads,...

-

Write a program (called assignment-1.cxx)-- (40 points) Write down the C++ program based on the following tasks. Creates an Array (1D array) and randomly assign values. Show the array with assigned...

-

on 17:03 Sat 11 May < 00 194843... 19871 II B itsSUNPI is live! + Hi mates im Alive chating and all the fun stuf that we do O COME & GET ME! -- Sunpi FE now Untitled... HYPE RESULTS T Potential...

-

An astronaut on the International Space Station gently releases a satellite that has a mass much smaller than the mass of the station. Describe the motion of the satellite after release.

-

When the Department of Homeland Security created a color-coded system to prepare government officials and the public against terrorist attacks, what did it do right and what did it do wrong?

-

In what ways is a cash flow statement likely to be useful?

-

Collettes S corporation holds a small amount of accumulated earnings and profits (AEP), requiring the use of a more complex set of distribution rules. Collettes accountant tells her that this AEP...

-

Collettes S corporation holds a small amount of accumulated earnings and profits (AEP), requiring the use of a more complex set of distribution rules. Collettes accountant tells her that this AEP...

-

Collettes S corporation holds a small amount of accumulated earnings and profits (AEP), requiring the use of a more complex set of distribution rules. Collettes accountant tells her that this AEP...

-

Q3. Company ABC has accounting income $500 for year 2016, 2017 and 2018, with following balance 2015 2016 2017 2018 Accounts Payable 100 110 120 90 Unearned Revenue 100 50 30 0 Prepaid Expense 100 80...

-

Deacon Company is a merchandising company that is preparing a budget for the three - month period ended June 3 0 th . The following information is available Deacon Company Balance Sheet March 3 1...

-

Mango Company applies overhead based on direct labor costs. For the current year, Mango Company estimated total overhead costs to be $460,000, and direct labor costs to be $230,000. Actual overhead...

Study smarter with the SolutionInn App