Since 2013, Halkirk Inc. (Halkirk) has estimated that its bad debt expense would be approximately 3 percent

Question:

Since 2013, Halkirk Inc. (Halkirk) has estimated that its bad debt expense would be approximately 3 percent of credit sales each year. In late 2014, Halkirk made a number of changes to its internal control procedures that increased the effectiveness of its credit granting and receivables collection. As a result, in 2015 uncollectibles decreased to about 2 percent of credit sales. However, the accounting department never bothered to lower the 3 percent rate that had been implemented in 2013.

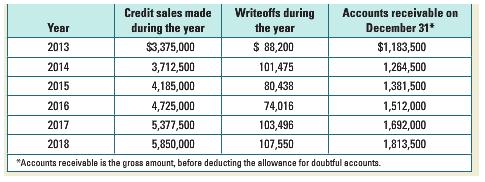

The following information is also available about Halkirk’s receivables and bad debts:

i. Halkirk’s year-end is December 31.

ii. The balance in Halkirk’s allowance account on January 1, 2013 was $90,000.

iii. Credit sales and writeoffs by year and accounts receivable on December 31 of each year were:

Required:

a. Calculate the bad debt expense Halkirk’s accounting department would have made in each year from 2013 through 2018.

b. Calculate the balance in allowance for uncollectible accounts on December 31 of each year, after the adjusting entry recording the bad debt expense for the year recorded.

c. Examine the balance in the allowance account over the period from 2013 through

2018. Explain what is happening to the allowance account as a result of using a percentage of credit sales that is consistently too high. (To answer, it might help to look at the balance in the allowance account as a percentage of accounts receivable.)

d. What is the effect on income each year of using a percentage of credit sales that is consistently too large? Explain.

e. What is the net amount of accounts receivable (accounts receivable—allowance for

uncollectibles) on Halkirk’s balance sheet on December 31, 2018? Does the amount on the balance sheet represent the net realizable value of the accounts receivable on December 31, 2018? Explain.

f. What would the balance in the allowance account be on December 31, 2018 after the adjusting entry for bad debts is made if Halkirk expensed 2 percent of credit sales as bad debts beginning in 2015?

g. Suppose that in 2018 management become aware of the error it was making estimating bad debts each year by using 3 percent of credit sales instead of 2 percent.

What journal entry would Halkirk have to make to reduce the balance in the allowance account to the amount calculated in (f)? What would the effect of this journal entry on net income be in 2018? What are some of the implications of these errors on users of the financial statements?

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer: