Stand-alone revenue allocation, Funland is an amusement park complex in southern Florida. Funland is divided into three

Question:

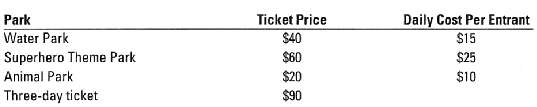

Stand-alone revenue allocation, Funland is an amusement park complex in southern Florida. Funland is divided into three autonomous divisions: a water park, a superhero theme park with rides, and an animal park. In addition to selling a daily entrance ticket for each park, Funland has decided to sell a three day ticket that would allow entrance into each of the parks for one day. The ticket selling price and the costs associated with each entrant into a park are:

1. Allocate the revenue from the three-day ticket to each park using the stand-alone method based on ticket price.

2. Allocate the revenue from the three-day ticket to each park using the stand-alone method based on cost per entrant.

3. Allocate the revenue from the three-day ticket to each park using the stand-alone method based on physical units (that is, number of tickets received for each park).

4. Which basis of allocation makes the most sense in this situation? Explain youranswer.

Step by Step Answer:

Cost Accounting A Managerial Emphasis

ISBN: 978-0136126638

13th Edition

Authors: Charles T. Horngren, Srikant M.Dater, George Foster, Madhav