On January 1, 1999, Pen Company purchased 80% of the outstanding voting shares of Silk Company for

Question:

On January 1, 1999, Pen Company purchased 80% of the outstanding voting shares of Silk Company for $300,000. Silk’s assets and liabilities all had fair values that were equal to their carrying values. The $80,000 excess of purchase price over 80% of the book values of Silk Company’s net assets was allocated to goodwill. Goodwill is tested for impairment on an annual basis. Between January 1, 1999, and January 1, 2005, Silk Company earned $200,000 and paid dividends of $40,000. Both companies use the straight-line method to calculate depreciation and amortization.

Additional Information:

1. On January 1, 1995, Silk Company purchased a machine for $100,000 that had an estimated useful life of 20 years; on January 1, 2000, Silk Company sold the machine to Pen Company for $60,000. The estimated useful life of the machine remains unchanged at a total of 20 years (15 years from January 1, 2000).

2. During 2005, Silk Company had sales of merchandise in the amount of $400,000 to Pen Company, of which $60,000 remains in the December 31, 2005, inventories of Pen Company. Pen Company had no sales to Silk Company during 2005, but had sales of $200,000 to Silk Company in 2004. Of these sales, $40,000 remained in the December 31, 2004, inventories of Silk Company. Intercompany sales are priced to provide the selling company with a 40% gross profit on sales prices.

3. On September 1, 2005, Silk Company sold a piece of land to Pen Company for $50,000. The land had been purchased for $35,000. The gain on this land is not considered extraordinary for reporting purposes.

4. During 2005, Silk Company declared dividends of $6,000 and Pen Company declared dividends of $35,000.

5. During 2005, Silk Company paid Pen Company $10,000 in management fees.

6. On July 1, 2005, Pen Company lent Silk Company $100,000 for five years at an annual interest rate of 10%. Interest is paid on July 1 of each year for which the loan is outstanding.

7. To date, there has been no impairment in the value of goodwill.

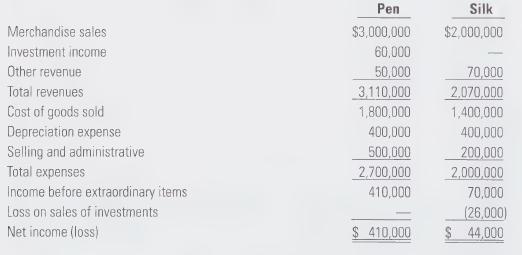

Pen Company carries its investment in Silk Company by the cost method. On this date, the income statements of Pen Company and Silk Company for the year ending December 31, 2005, are as follows:

Required:

a. Prepare the consolidated income statement for Pen Company and its subsidiary, Silk Company, for the year ending December 31, 2005.

b. Assume that Pen Company prepares separate-entity statements for its bank and uses the equity method of reporting its investment in Silk. Provide a detailed calculation of Pen Company's investment income for the year ending December 31, 2005.

Step by Step Answer: