Hotbox Ltd produces pizza boxes using two processes cutting and packaging. The production budget for the

Question:

Hotbox Ltd produces pizza boxes using two processes — cutting and packaging. The production budget for the year ending 30 June 2019 estimated raw materials use of $400 000, factory overhead of $270 000, direct labour costs of $190 000 and 168 750 machine hours. (Ignore GST.)

During April 2019, the following transactions were recorded:

1. raw materials transferred to cutting, $21 600 raw materials transferred to packaging, $28 000 2. direct labour costs incurred by cutting, $15 800 direct labour costs incurred by packaging, $20 200 3. machine hours used by cutting, 13 800 hours machine hours used by packaging, 17 600 hours 4. Other production costs for April were as follows.

5. Product with an assigned cost of $61 400 was transferred from cutting to packaging.

6. Overhead was applied in each department based on machine hours used. (A predetermined rate based on estimated overheads and total machine hours over both departments is to be calculated.)

7. Raw material purchases were $56 000.

8. Goods with an assigned cost of $136 000 were transferred from packaging to finished goods.

9. Finished goods with an assigned cost of $140 000 were sold on credit for $162 000.

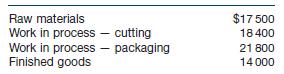

10. Beginning inventory as at 1 April comprised the following amounts.

Required

(a) Prepare journal entries to record the April transactions. Assume all expenses were paid in cash. Use Factory Overhead and Factory Overhead Applied accounts.

(b) Calculate ending work in process and finished goods balances in each process.

(c) Was overhead underapplied or overapplied in April? By what amount?

Step by Step Answer:

Accounting

ISBN: 9780730363224

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Beattie Claire, Hellmann Andreas, Maxfield Jodie