SpeedBurn Ltd manufactures DVD burners and is considering expanding production. A distributor has asked the company to

Question:

SpeedBurn Ltd manufactures DVD burners and is considering expanding production. A distributor has asked the company to produce a special order of 3000 DVD burners. The burners will be sold using a different brand name and will not influence SpeedBurn Ltd’s current sales. The plant is currently producing 28 000 units per year. Total capacity is 30 000 units per year, so the company will have to reduce the production of units sold under its own brand name by 1000 units if the special order is accepted.

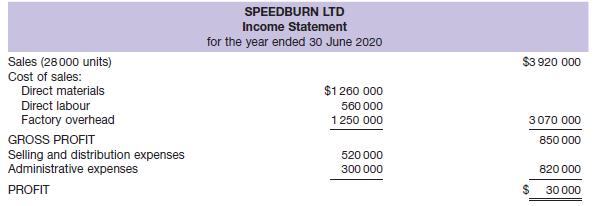

The company’s income statement for the previous financial year ended 30 June 2020 is summarised below.

The company’s variable factory overhead is $30 per unit, and the variable selling and distribution expenses are $10 per unit. The administrative expenses are completely fixed and will increase by $10 000 if the special order is accepted. There will be no variable selling and distribution expenses associated with the special order, and variable factory overhead per unit will remain constant.

The company’s direct labour cost per unit for the special order will increase 5%, and direct materials cost per unit for the special order will decrease 5%. Fixed factory overhead and fixed selling and distribution expenses will not change.

Required

(a) If the distributor has offered to pay $110 per unit for the special order, should the company accept the offer? Show calculations to support your conclusion.

Step by Step Answer:

Accounting

ISBN: 9780730363224

10th Edition

Authors: John Hoggett, John Medlin, Keryn Chalmers, Beattie Claire, Hellmann Andreas, Maxfield Jodie