On 1 April 2004 Joel Ltd acquired the partnership business of Kay and Ola. The partnership Balance

Question:

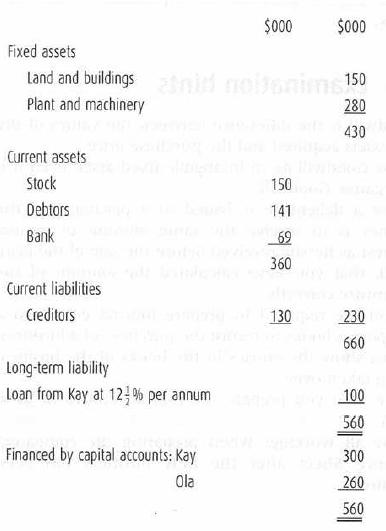

On 1 April 2004 Joel Ltd acquired the partnership business of Kay and Ola. The partnership Balance Sheet at 31 March 2004 was as follows.

Further information

1. The assets (including the bank account) and current liabilities were taken over at the following valuations.

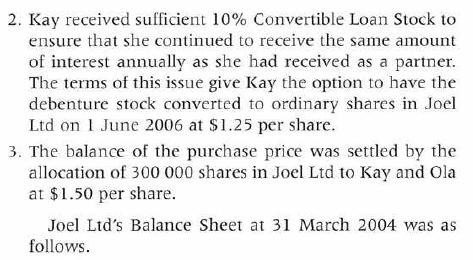

2. Kay received sufficient 10% Convertible Loan Stock to ensure that she continued to receive the same amount of interest annually as she had received as a partner. The terms of this issue give Kay the option to have the debenture stock converted to ordinary shares in Joel Ltd on 1 June 2006 at $1.25 per share.

2. Kay received sufficient 10% Convertible Loan Stock to ensure that she continued to receive the same amount of interest annually as she had received as a partner. The terms of this issue give Kay the option to have the debenture stock converted to ordinary shares in Joel Ltd on 1 June 2006 at $1.25 per share.

3. The balance of the purchase price was settled by the allocation of 300 000 shares in Joel Ltd to Kay and Ola at $1.50 per share.

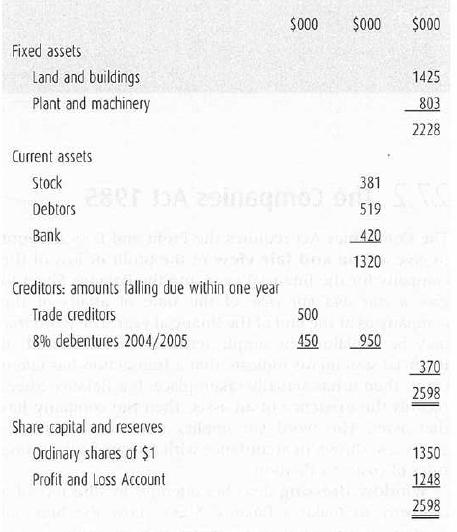

Joel Ltd's Balance Sheet at 31 March 2004 was as follows.

Immediately following the acquisition of the partnership, Joel Ltd redeemed its 8% debentures 2004/2005 at a premium of 4%. In order to preserve the capital structure of the company, a reserve equal to the amount of the debentures redeemed was created.

Required

(a) Prepare Joel Ltd's Balance Sheet as it appeared immediately after it had acquired the partnership of Kay and Ola and redeemed the 8% debentures. (Show all workings.)

(b) Calculate the profit required on Joel Ltd's investment in the partnership business to produce a return of 25% on the investment.

On 1 June 2006 the market price of Joel Ltd's shares was $1.37.

(c)

(c)

(i) State, with reason, whether Kay should convert her 10% convertible loan stock into ordinary shares in Joel Ltd.

(ii) State the effect that the conversion of Kay's 10% convertible loan stock into shares would have on Joel Ltd's Balance Sheet.

Step by Step Answer: