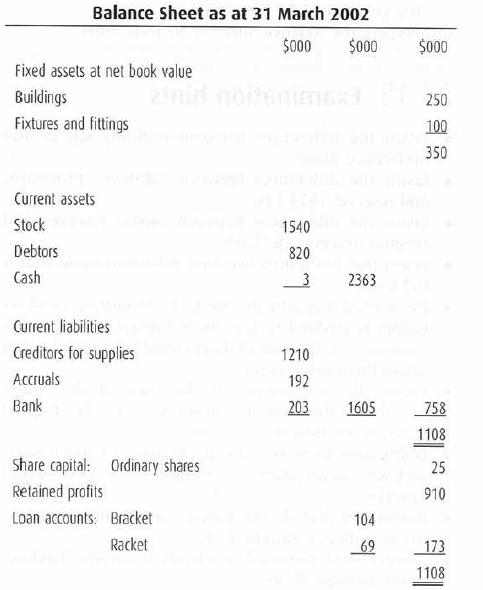

The following is the summarised Balance Sheet of Bracket & Racket Ltd, a limited company wholly owned

Question:

The following is the summarised Balance Sheet of Bracket & Racket Ltd, a limited company wholly owned by its two shareholders, Bracket and Racket.

The company accountant resigned at the beginning of April 2002 and proper records were not kept for the six-month period 1 April to 30 September 2002.

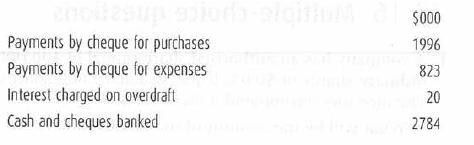

The following information is available for that six- month period.

Included in the amount banked was $53 000 for the sale of an unused building, book value $70 000.

Prior to banking the takings,

(i) $205 000 was used to pay wages for the six months;

(ii) Bracket and Racket each reduced their loans to the firm by $45 000.

Depreciation on all fixed assets which remain in the company's books at the end of an accounting period is calculated at 25% per annum on the net book value.

At 30 September 2002 the following figures were available.

Doubtful debts are estimated at 5% at 30 September 2002 and a provision for doubtful debts at that date is to be created.

Required

(a) A Trading and Profit and Loss Account for Bracket and Racket Ltd for the six months ended 30 September 2002.

(b) A Balance Sheet for Bracket and Racket Ltd at 30 September 2002.

Step by Step Answer: