Wilson, Keppel and Betty were in partnership and shared profits and losses equally. They did not operate

Question:

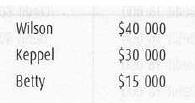

Wilson, Keppel and Betty were in partnership and shared profits and losses equally. They did not operate Current accounts and on 30 April 1998 their Capital accounts showed the following balances.

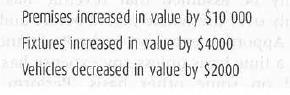

(a) Keppel retired from the partnership on 1 May 1998. and at that time Goodwill was valued at $24 000. Fixed assets were revalued as follows.

It was agreed that neither a Goodwill account nor a Revaluation account would be shown in the partnership books. Keppel received cash for his share of the partnership and Wilson and Betty continued to run the partnership still sharing the profits equally. Drawings during the year ended 30 April 1999 were Wilson $46 000 and Betty $45 000. Net profit for that year was $120 000.

Required

Draw up the partners' Capital accounts for the year ended 30 April 1999 in columnar form.

(b) Imogen joined the partnership on 1 November 1999, bringing in capital of $12 000 and $8000 as her share of Goodwill. No Goodwill account was opened. Profits were now to be shared on the following basis:

During the year ended 30 April 2000 profits amounted to $140 000 and partners' drawings were Wilson $52 000, Betty $48000 and Imogen $20 000. Profits accumulated at a regular rate throughout the year. The partnership was sold on 1 May 2000 for $126 000. The partnership was dissolved and all of the partners took the money due to them.

Draw up the partners' Capital accounts for the period 1 May 1999 to 1 May 2000, in columnar form.

Step by Step Answer: