A passenger coach company is considering the purchase of a new fleet of luxury coaches. The coaches

Question:

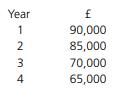

A passenger coach company is considering the purchase of a new fleet of luxury coaches. The coaches will cost £220,000 in total and will have a useful life of four years, after which time they will be sold for a total of £20,000. Forecast profits before depreciation from the operation of the coaches are as follows.

Calculate the following for the proposed investment:

(a) The payback period

(b) The net present value of the cash flows, using a discount rate of 15 per cent

(c) The internal rate of return

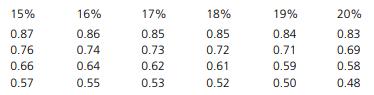

(d) The accounting rate of return. The discount factors you will need are as follows.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Accounting In A Nutshell Accounting For The Non-specialist

ISBN: 9780750687386

3rd Edition

Authors: Walker, Janet

Question Posted: