A company is considering investing in a new production facility at a cost of $120 million. The

Question:

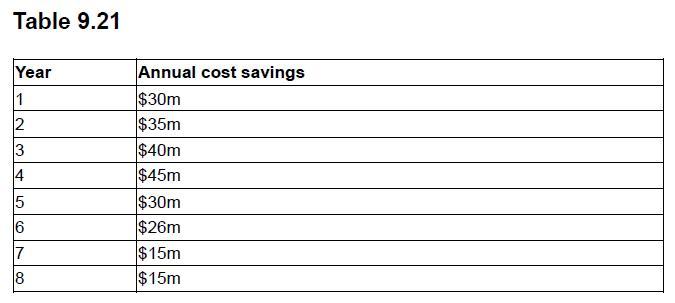

A company is considering investing in a new production facility at a cost of $120 million. The new facility is expected to produce annual cost savings as set out in Table 9.21. The facility is expected to have a useful life of eight years, before becoming obsolete and requiring replacement. The company has a policy of depreciating all assets on a straight-line basis.

Required:

Evaluate the investment using the following techniques:

(a) Payback period – the company considers a capital investment to be acceptable if it pays back within four years. Should the company make the investment?

(b) ARR – what is the accounting rate of return on the average capital employed?

(c) NPV – if the capital investment has a required rate of return of 12 per cent, what is its net present value? Should the company make the investment?

Step by Step Answer:

Accounting And Finance For Managers A Decision Making Approach

ISBN: 9780749469139

1st Edition

Authors: Matt Bamber, Simon Parry