ANG Co is a manufacturer of high-performance processor chips for smart phones and other mobile devices. The

Question:

ANG Co is a manufacturer of high-performance processor chips for smart phones and other mobile devices. The company, based in Europe, has grown rapidly over the last five years. It has been able to compete with global competitors through developing a highly skilled and loyal workforce.

The company forecasts continued growth in existing markets and intends to break into the new markets of China and South East Asia. With this in mind, the directors have been examining options for opening a new factory within the next 18 months.

The directors have identified three possible new sites for the factory. You have been appointed as a business consultant to help the business choose which site to develop.

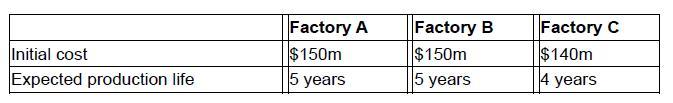

The financial information for each factory is set out in Table 9.22.

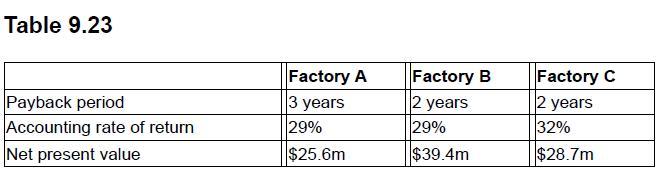

The company accountant has calculated the information shown in Table 9.23.

The NPV is calculated using the company’s standard discount rate of 13 per cent.

The following further details are provided:

Factory A: This factory will be opened next to the existing factory. This will provide more jobs for people in the area and possible promotion opportunities for existing employees.

Factory B: Factory B will be located in a new enterprise development zone which is situated approximately 150 kilometres from the existing factory. By opening the factory here, the company can take advantage of some generous tax breaks and other incentives offered by the government. Opening this factory will involve moving some of the existing production into the new factory. This will mean making 20 per cent of the existing workforce redundant. (The cost of redundancies is built into the figures above.)

Factory C: This factory will be opened in China. The company will benefit from cheaper labour costs (this is built into the figures above). The company will also be in a strong geographic position to grow sales in the newly opened market in China and South East Asia.

Required:

Write a report to the directors of ANG Co which evaluates each of the three potential investments using the financial and non-financial information provided above. State what further information the directors might need to consider before making a final decision.

Step by Step Answer:

Accounting And Finance For Managers A Decision Making Approach

ISBN: 9780749469139

1st Edition

Authors: Matt Bamber, Simon Parry