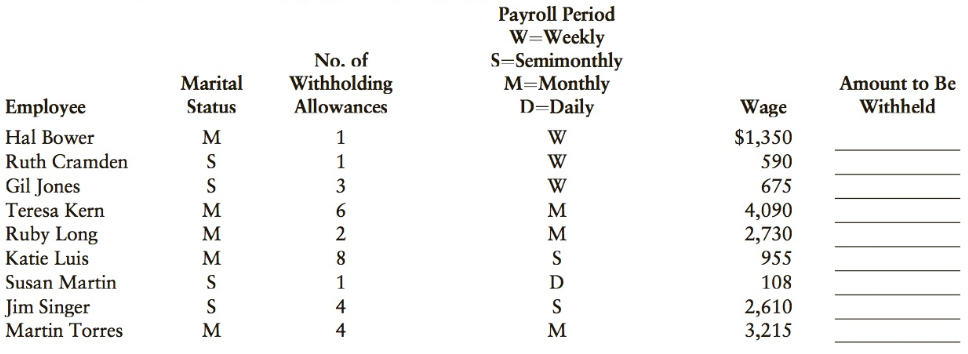

Eaton Enterprises uses the wage-bracket method to determine federal income tax withholding on its employees. Find the

Question:

Transcribed Image Text:

Payroll Period W=Weekly No. of Withholding S=Semimonthly Amount to Be Withheld Marital Status M=Monthly D=Daily Employee Hal Bower Allowances Wage $1,350 M Ruth Cramden Gil Jones 590 3 675 Teresa Kern Ruby Long Katie Luis Susan Martin Jim Singer Martin Torres M 4,090 2,730 M 8. 955 108 4 4 2,610 3,215 M SSMMMSSM

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (10 reviews)

Employee Marital Status No of Withholding Allowances Payroll Period W Weekly S Semimonthly M M...View the full answer

Answered By

Bhartendu Goyal

Professional, Experienced, and Expert tutor who will provide speedy and to-the-point solutions. I have been teaching students for 5 years now in different subjects and it's truly been one of the most rewarding experiences of my life. I have also done one-to-one tutoring with 100+ students and help them achieve great subject knowledge. I have expertise in computer subjects like C++, C, Java, and Python programming and other computer Science related fields. Many of my student's parents message me that your lessons improved their children's grades and this is the best only thing you want as a tea...

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Ernesto Enterprises uses the wage-bracket method to determine federal income tax withholding on its employees. Find the amount to withhold from the wages paid each employee. No. of Withholding...

-

Calculate Federal Income Tax Withholding Using Two Methods (pre-2020 Form W-4) For each employee listed, use both the wage-bracket method and the percentage method to calculate federal income tax...

-

Marys Luxury Travel uses a weekly federal income tax withholding table. Refer to Figure 8-4 in the text. The payroll data for each employee for the week ended March 22, 20, are given. Employees are...

-

Assume that global lightning on the Earth constitutes a constant current of 1.00 kA between the ground and an atmospheric layer at potential 260 kV. (a) Find the power of terrestrial lightning. (b)...

-

Alicia has been working for JMM Corp. for 32 years. Alicia participates in JMM's defined benefit plan. Under the plan, for every year of service for JMM she is to receive 2 percent of the average...

-

To purge pro forma programs of error, they should be: a. Type written. b. Given a trial run. c. Reviewed by the audit department manager. d. Thoroughly proofread. e. Reviewed by the auditee.

-

1 (a) Using Netflix as an example, explain how a mission statement gives it a strategic direction. (b) Create a mission statement for your own career.

-

Alfonza Incorporated presents its statement of cash flows using the indirect method. The following accounts and corresponding balances were drawn from the company's 2017 and 2016 year-end balance...

-

Required For each of the following situations, calculate the amount of bond discount or premium, if any. (Do not round your intermediate calculations.)

-

A food company produces tomato sauce at five different plants. The tomato sauce is then shipped to one of three warehouses, where it is stored until it is shipped to one of the companys four...

-

Sean Matthews is a waiter at the Duluxe Lounge. In his first weekly pay in March, he earned $300.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer...

-

The names of the employees of Hogan Thrift Shop are listed on the following payroll register. Employees are paid weekly. The marital status and the number of allowances claimed are shown on the...

-

Find the median salary in the preceding list of seven salaries. Preceding data of salaries Occasionally, the mean can be misleading as a measure of central tendency. Suppose the annual salaries of...

-

The State of Confusion Legislature passes the following statute: "The State Health Commissioner, when in their opinion, there is sufficient covid - 1 9 vaccine that has been approved by the Federal...

-

Case 1 Baum Co. has two processing departments: Fabrication and Assembly. In the Fabrication Department, metal is cut and formed into various components, which are then transferred to Assembly. The...

-

Your earlier Personal Leadership Assessment, you looked at two areas of your leadership experience, those who led you and those you led. You will again address these two items in your Personal...

-

What is required in this situation: Content slides explaining the qualitative and quantitative steps necessary in conducting a sensitivity analysis. How can a project's risk be incorporated into a...

-

What is "marketing"? What is the difference between "marketing" and the "marketing process"?is it different in your home country vs. North america? Q2. What is the difference between "demand",...

-

Find a basis for the solution space of the difference equation. Prove that the solutions you find span the solution set. Yk+225yk = 0

-

5. How much would you need to deposit in an account now in order to have $5,000 in the account in 5 years? Assume the account earns 2% interest compounded monthly. 10. You deposit $300 each month...

-

Refer to Problem 3-11A. Complete Parts 2, 4, and 5 of Form 941 for Cruz Company for the third quarter of 2016. Cruz Company is a monthly depositor with the following monthly tax liabilities for this...

-

Karen Kluster opened Lube and Wash on January 1, 2016. The business is subject to FICA taxes. At the end of the first quarter of 2016, Kluster, as president of the company, must file Form 941,...

-

During the third calendar quarter of 20--, Bayview Inn, owned by Diane R. Peters, employed the persons listed below. Also given are the employees' salaries or wages and the amount of tips reported to...

-

please help Problem 13-7 (Algo) Prepare a Statement of Cash Flows [LO13-1, LO13-2] [The following information applies to the questions displayed below.] Comparative financial statements for Weaver...

-

A firm has 1000 shareholders, each of whom own $59 in shares. The firm uses $28000 to repurchase shares. What percentage of the firm did each of the remaining shareholders own before the repurchase,...

-

Vancouver Bank agrees to lend $ 180,000 to Surrey Corp. on November 1, 2020 and the company signs a six-month, 6% note maturing on May 1, 2021. Surrey Corp. follows IFRS and has a December 31 fiscal...

Study smarter with the SolutionInn App