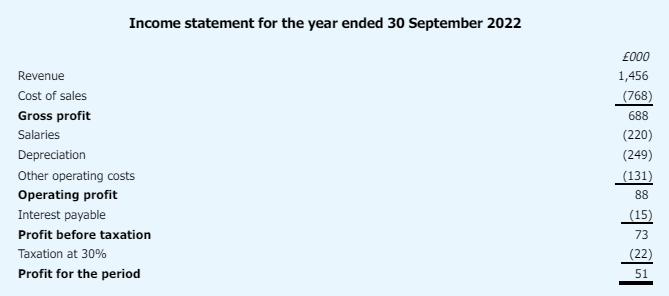

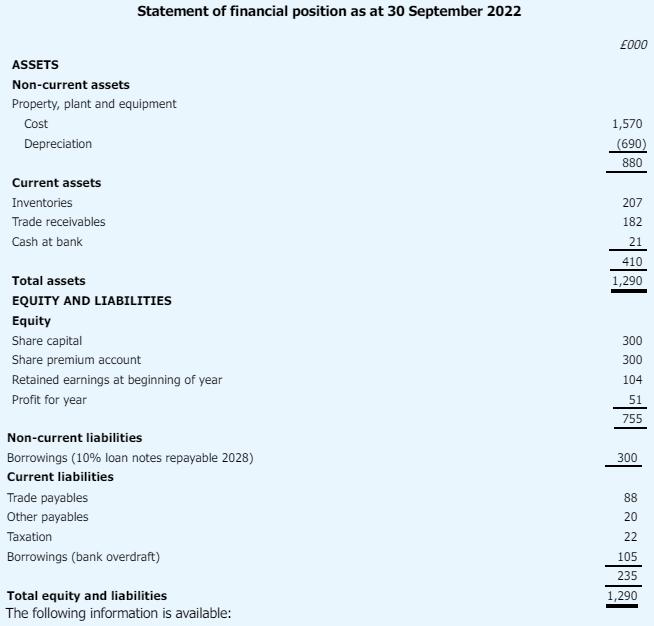

The following is a draft set of simplified financial statements for Pear Limited for the year ended

Question:

The following is a draft set of simplified financial statements for Pear Limited for the year ended 30 September 2022.

1 Depreciation has not been charged on office equipment with a carrying amount of £100,000 This class of assets is depreciated at 12 per cent a year using the reducing-balance method. 2 A new machine was purchased, on credit, for £30,000 and delivered on 29 September 2022 but has not been included in the financial statements. (Ignore depreciation.)

3 A sales invoice to the value of £18,000 for September 2022 has been omitted from the financial statements.

(The cost of sales figure is stated correctly.)

4 A dividend of £25,000 had been approved by the shareholders before 30 September 2022, but was unpaid at that date. This is not reflected in the financial statements.

5 The interest payable on the loan notes for the second half-year was not paid until 1 October 2022 and has not been included in the financial statements.

6 An allowance for trade receivables is to be made at the level of 2 per cent of trade receivables. 7 An invoice for electricity to the value of £2,000 for the quarter ended 30 September 2022 arrived on 4 October 2022 and has not been included in the financial statements.

8 The charge for taxation will have to be revised to take account of any amendments to the taxable profit arising from items 1 to 7. Make the simplifying assumption that tax is payable shortly after the end of the year, at the rate of 30 per cent of the profit before tax.

Required:

Prepare a revised set of financial statements for the year ended 30 September 2022 incorporating the additional information in 1 to 8 above. (Work to the nearest £1,000.)

Step by Step Answer:

Accounting And Finance An Introduction

ISBN: 9781292435527

11th Edition

Authors: Eddie McLaney, Peter Atrill